Looking for an affordable auto loan with great rates and flexible terms? Consumers Credit Union auto loans offer competitive financing options that can save you money on your next car purchase. Whether you’re buying new, used, or even refinancing, a Consumers Credit Union auto loan could help you get behind the wheel with lower monthly payments and member-friendly perks. Let’s explore why their auto loans stand out—and how you can qualify for the best deal.

1: Introduction – Why Consumers Credit Union Auto Loans Beat Banks

Myth Buster: “You NEED perfect credit to get a good auto loan rate.”

Truth: Consumers Credit Union (CCU) auto loans often approve lower credit scores with rates that beat big banks—even if your score isn’t flawless.

Why This Matters

Shopping for a car? Don’t just accept the dealer’s financing or bank rates. Credit unions like CCU offer:

- Lower interest rates (sometimes 2% less than banks!)

- Flexible terms (choose 36–72 months, no pressure)

- Fast, member-friendly service

Real Talk: “A 0.5% lower rate on a 25,000loan=500+ saved. That’s free money for your next road trip!”

Who Is This For?

✅ Budget buyers (used or new cars)

✅ Folks with fair credit (scores as low as 650? Possible!)

✅ Anyone tired of bank hassles

🔥 Hot Tip: “Dealerships mark up loan rates. CCU gives you direct rates, so you walk in with buying power.”

2: What Exactly Is a Consumers Credit Union Auto Loan?

Credit Unions vs. Banks – The Big Difference

Banks profit off you. Credit unions serve members (that’s you!). CCU auto loans come with:

- Non-profit rates (transparent, no hidden fees)

- Member perks (discounts, easy refinancing)

Key Features of CCU Auto Loans

1️⃣ Low APR Options

- “New car rates from 4.99%, used from 5.49% (2024 rates)—way better than Chase or Wells Fargo!”

2️⃣ Used & New Car Loans

- “Buying a 2018 Honda? CCU covers cars up to 10 years old.”

3️⃣ Pre-Approval in Minutes

- “Online application → soft credit check → get a rate without hurting your score.”

But Wait… Do You Qualify?

CCU requires membership, but joining is easy:

- Live/work in their service area? You’re in!

- Is a family member already a CCU member? You’re in!

💡 Pro Hack: “Even if you don’t qualify yet, some CCUs let you join for a $5 donation. Cheaper than a bank’s loan fee!“

3: Consumers Credit Union Auto Loan Rates (2024 Update) – The Real Deal

Myth Buster: “All auto loan rates are basically the same.”

Truth: Your rate can vary wildly—by 2-5% or more—depending on where you get your loan. And guess what? Consumers Credit Union (CCU) consistently offers some of the lowest rates around.

2024 CCU Auto Loan Rates at a Glance

Here’s the scoop on current CCU auto loan rates (as of 2024):

New Cars: Starting at 4.99% APR

Used Cars (1-3 years old): Starting at 5.49% APR

Used Cars (4-10 years old): Starting at 6.24% APR

💡 Pro Tip: “Dealerships often mark up rates by 1-3%. Walking in with CCU pre-approval? That’s your secret weapon for negotiation.”

What Affects Your CCU Auto Loan Rate?

Your rate isn’t just pulled out of thin air. Here’s what CCU looks at:

1️⃣ Credit Score

- “720+? You’ll snag the lowest rates.”

- “650-719? Still good, but expect slightly higher APR.”

- “Below 650? CCU might still approve you—but with a higher rate.”

2️⃣ Loan Term

- “Shorter terms (36-48 months) = lower rates.”

- “Longer terms (60-72 months) = slightly higher rates (but lower payments).”

3️⃣ Down Payment

- “Putting 10-20% down? CCU might reward you with a better rate.”

4️⃣ Vehicle Age & Mileage

- “New cars get the best rates. Older/high-mileage cars? Slightly higher.”

🚀 Quick Hack: “Check your credit report before applying. Fixing small errors can boost your score—and lower your rate!”

Read more about: American Express Auto Loan Rates in 2024

4: Who Qualifies for a Consumers Credit Union Auto Loan? (No Guesswork!)

Myth Buster: “Credit unions are super exclusive—only certain people can join.”

Truth: Joining CCU is way easier than you think—and once you’re in, you’re eligible for their auto loans.

Step 1: Become a CCU Member (It’s Simple!)

CCU is not-for-profit, meaning it serves members, not shareholders. Here’s how to join:

✔ Live, Work, or Worship in Their Service Area? → You qualify!

✔ Family Member Already a CCU Member? → You’re in!

✔ Don’t Meet Either? Some CCUs let you join with a small donation (5−5−25) to a partner charity.

💡 Pro Tip: “Call your local CCU branch—sometimes they have hidden eligibility options (like working for certain employers).”

Step 2: Auto Loan Eligibility (What CCU Checks)

Once you’re a member, CCU looks at:

1️⃣ Credit Score

- “620+ is often the minimum, but 700+ gets you the best rates.”

2️⃣ Income & Debt

- “They’ll check if you can afford payments (usually DTI under 45%).”

3️⃣ Loan Amount vs. Car Value

- “CCU typically finances up to 100-125% of the car’s value.”

🚀 Quick Hack: “If your credit’s shaky, a co-signer (like a family member) can help you qualify!”

What If You Have Bad Credit?

CCU isn’t just for perfect-credit borrowers. They sometimes approve folks with:

✔ Recent credit blemishes

✔ Thin credit history

🔥 Insider Tip: “Already a CCU member with a checking account? You might get a loyalty rate discount!”

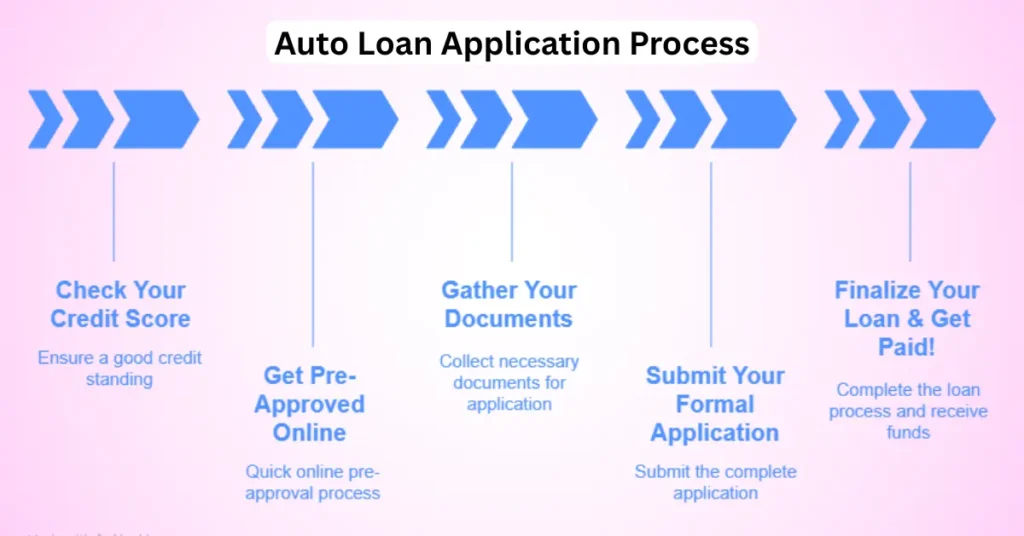

5: How to Apply for a Consumers Credit Union Auto Loan (5 Easy Steps!)

Myth Buster: “Getting a credit union auto loan takes forever with tons of paperwork.”

Truth: Applying for a Consumers Credit Union auto loan is actually FASTER than most banks – often with same-day approval! Here’s how to breeze through the process.

Step 1: Check Your Credit Score (Don’t Skip This!)

Get your free credit report at AnnualCreditReport.com

CCU typically looks for scores 650+

Fix any errors BEFORE applying

💡 Pro Tip: “A 50-point credit score jump could save you $1,000+ in interest!”

Step 2: Get Pre-Approved Online (Takes 5 Minutes)

Visit CCU’s auto loan page

Fill out basic info (no hard credit pull yet)

Get your rate estimate

🔥 Hot Fact: “Pre-approval gives you negotiating power at dealerships!”

Step 3: Gather Your Documents

You’ll need:

- Driver’s license

- Pay stubs (last 30 days)

- Proof of insurance

- Vehicle information

Step 4: Submit Your Formal Application

Complete full application (online or in-branch)

Hard credit check happens now

Typically get the decision within one business day

Step 5: Finalize Your Loan & Get Paid!

Sign final paperwork

Get your check or direct dealer payment

Drive away in your new ride!

🚀 Bonus Hack: “Apply Monday-Thursday mornings for fastest processing – loan officers are freshest!”

6: Consumers Credit Union Auto Loans – The REAL Pros & Cons

Myth Buster: “Credit unions are just smaller versions of banks.”

Truth: CCU operates completely differently, which means unique advantages (and a few limitations) for your auto loan.

👍 The BIG Advantages

1. Lower Rates (Save Thousands!)

✔ Average 1-2% lower than big banks

✔ No hidden dealer markups

2. Flexible Terms

✔ Choose 36-84 month terms

✔ No prepayment penalties

3. Member-First Service

✔ Local decision-makers

✔ Quick problem resolution (Keyword Variation: “CCU auto loan customer service”)

👎 The Potential Drawbacks

1. Membership Required

➡ Need to qualify (but it’s easy!)

➡ 5−25 deposit to open account

2. Fewer Physical Branches

➡ Mostly online/phone service

➡ Limited in-person help

3. Stricter Used Car Rules

➡ May not finance very old/high-mileage cars

➡ Inspection sometimes required

💡 The Verdict?

“If you want the lowest rates and don’t mind joining, CCU auto loans beat banks 9 times out of 10. But if you need in-person service everywhere, consider your options.”

7: Refinancing Your Auto Loan with Consumers Credit Union (When & How)

Myth Buster: “Refinancing isn’t worth the hassle for small savings.”

Truth: Even a 1% rate drop on a 25k loan saves you∗∗500+** – for about an hour of work! Here’s when CCU refinancing makes sense:

⏰ When to Refinance with CCU

✔ Rates Dropped? (CCU’s rates have fallen since you got your loan)

✔ Credit Improved? (Raised your score 50+ points?)

✔ Financial Changes? (Need lower payments or shorter term)

💡 Pro Tip: “The sweet spot? When you can save 1%+ APR AND plan to keep the car 12+ months.”

🔍 How CCU Refinancing Works (3 Simple Steps)

1️⃣ Check Current Rate vs. CCU’s Offer

- CCU often beats banks by 1-3%

2️⃣ Apply Online (10 Minutes)

- The same easy process as new loans

- Soft pull first to check rates

3️⃣ Close & Start Saving

- CCU pays off your old loan

- You get new (lower!) monthly payments

🚨 Watch Out For:

➔ Prepayment penalties (rare with CCU)

➔ Extended terms (don’t just stretch payments to save)

🔥 Hot Hack: “Refinance + auto-pay = Extra 0.25% discount at many CCUs!”

8: Consumers Credit Union Auto Loans – Your Top Questions ANSWERED

Myth Buster: “You need perfect credit to get CCU’s best rates.”

Truth: While 720+ scores get prime rates, CCU often approves borrowers with scores as low as 620 – with smart strategies!

🚗 5 Burning Questions (With Real Answers)

1️⃣ “What’s the minimum credit score for CCU auto loans?”

✔ 620+ gets approval

✔ 700+ scores snag the lowest rates

2️⃣ “Does CCU offer $0 down payment loans?”

✔ Sometimes! But 10-20% down gets better rates

3️⃣ “How fast does CCU approve auto loans?”

✔ Pre-approval in minutes

✔ Full approval in 1-2 business days

4️⃣ “Can I pay off my CCU loan early?”

✔ YES! No prepayment penalties

5️⃣ “Is CCU better than dealer financing?”

✔ Almost always – dealers mark up rates 1-3%

✔ Exception: Manufacturer 0% deals may beat CCU

💡 Bonus Tip: “Already have a CCU checking account? Ask about relationship discounts!”