“Drowning in student loans? You can learn how to pay off student loans fast—even on a tight budget. These 7 proven strategies have helped thousands slash their debt quickly, from smart repayment hacks to easy side hustles. No fluff, just real ways to save thousands and escape loan stress faster.”

1: The Student Loan Trap—And How to Escape It Faster Than You Think

💡 Myth Buster: “You have to live with student loans for decades. There’s no way out.”

🔥 Truth: Wrong! With the right strategies, you can pay off student loans fast—even if you’re not making six figures.

😩 Why Student Loans Feel Like a Life Sentence

Let’s be real—student debt sucks. You did everything “right”: went to school, got a degree, and now you’re stuck with a monthly payment that feels like a second rent. Worse? The interest keeps piling up, making it feel like you’re running on a debt treadmill.

- 📉 The interest trap: If you’ve got a 50Kloanat619,000+ extra if you drag it out for 20 years.

- 😤 The frustration: You could be using that money for a house, travel, or investing—but instead, it’s going to Sallie Mae.

- 🤯 The mental toll: 60% of borrowers say student loans cause stress, anxiety, or depression.

🎯 The Good News? You CAN Pay Them Off Faster

You don’t have to follow the “standard 10-year plan.” There are smarter, faster ways to crush your student loans—even if you’re on a tight budget.

Proven methods (we’ll cover 7 of them).

Real-life examples (people paying off $50K+ in 3-5 years).

No extreme sacrifices (just smart moves).

2: Why Paying Off Student Loans Fast Is a Game-Changer

🕳️ The Problem: Slow Repayment = More Money Wasted

Think of your student loan like a leaky bucket. The longer you take to pay it off, the more money drips out in interest.

- Example: A 30Kloanat59,000 extra if you take 20 years instead of 10.

- 💡 Key Insight: “Paying just 100 extra per month could save you10K+ over time.”

🚀 3 Reasons to Speed Up Your Payoff

1️⃣ You’ll Save Thousands (Literally)

- Math doesn’t lie: The faster you pay, the less interest piles up.

- 💰 Smart move: Refinancing to a lower rate (if you qualify) can slash your total cost.

2️⃣ You’ll Have More Freedom Sooner

- No debt = better career choices (no staying in a job just for loan help).

- 🏡 Buying a house? Lenders look at your debt-to-income ratio.

- ✈️ Want to travel? No more loan payments eating your budget.

3️⃣ Your Mental Health Will Thank You

- No more: “Ugh, another payment due.”

- Instead: “I’m in control of my money.”

- Studies show debt freedom reduces stress—big time.

🔥 Bottom Line

Paying off student loans fast isn’t just about money—it’s about freedom, flexibility, and peace of mind.

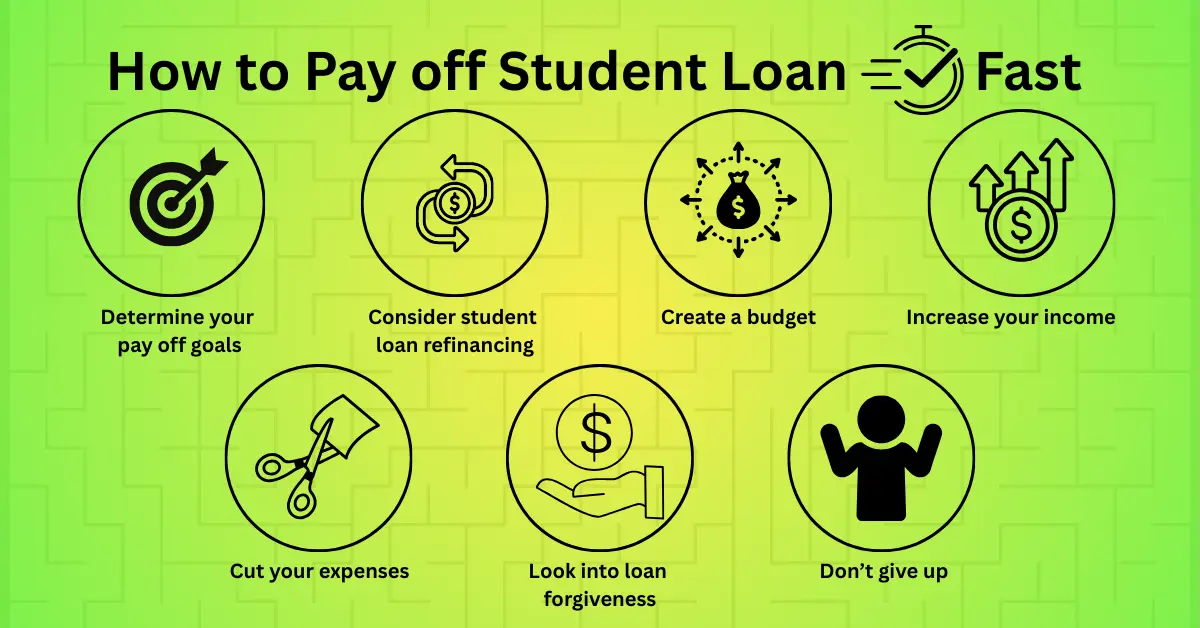

3: 7 Proven Ways to Pay Off Student Loans Fast (Even If You’re Broke)

💡 Myth Buster: “You need a six-figure salary to make a dent in student loans.”

🔥 Truth: Nope! With the right strategies, you can accelerate your payoff no matter your income. Let’s break down 7 real-world tactics that work.

⚡ 3.1 Throw Every Extra Dollar at Your Loans (The Fastest Fix)

How it works:

- Got a tax refund? Use it.

- Birthday cash? Use it.

- Side hustle earnings? USE IT.

- Example: Paying just 200 extra/month on a 30K loan could shave off 4+ years of payments.

Pro Tip:

“Set up automatic overpayments—you won’t even miss the money.”

💳 3.2 Refinance for a Lower Rate (Save Thousands)

When it’s golden:

✔️ You have good credit (650+).

✔️ You have private loans (not federal—you’ll lose forgiveness options).

The math:

- Refinancing a 50K loan from 790/month ($32K over 20 years!).

⚠️ Warning:

“Federal loan borrowers: Don’t refinance unless you’re 100% sure you won’t need income-driven repayment or PSLF.”

📉 3.3 The Debt Avalanche Method (Crush High-Interest First)

Step-by-step:

- List all loans by interest rate (highest to lowest).

- Pay minimums on all except the top offender.

- Attack the highest-rate loan with every extra penny.

Why it wins:

- Saves you the most interest long-term.

- Example: Paying off a 6.8% federal loan first vs. a 3.5% one keeps thousands in your pocket.

💼 3.4 Side Hustles Just for Loan Payoff

Best gigs for fast cash:

- 🚗 Rideshare driving ($500+/month).

- ✍️ Freelance writing (Upwork, Fiverr).

- 🛍️ Sell unused stuff (eBay, Facebook Marketplace).

Mind-blowing stat:

“A 1,000/month side hustle could wipe out a 30K loan in 3 years!”

✂️ 3.5 Cut Expenses Like a Pro (Live Lean, Pay More)

Painless cuts:

- ☕ Skip Starbucks (5/day=150/month → $1,800/year!).

- 📱 Downgrade your phone plan (Save $ 40/month).

- 🏠 Get a roommate (Split rent = $500+/month saved).

Mindset shift:

“Temporary sacrifices = permanent freedom.”

🏛️ 3.6 Employer Help & Forgiveness Programs

Free money alerts:

- PSLF (Public Service Loan Forgiveness): Work for gov/nonprofit? 100% debt cancellation after 10 years.

- Employer perks: Companies like Chegg, Aetna, and Fidelity contribute to loans (100−300/month!).

⏱️ 3.7 Biweekly Payments (The Sneaky Hack)

How it works:

- Split your monthly payment in half.

- Pay every 2 weeks instead of once/month.

- Result: You make 13 full payments/year instead of 12 (no extra effort!).

Example:

400/month→200 every 2 weeks = 5,200/year vs. 4,800. That’s $400 extra annually!

4: What NOT to Do (Costly Student Loan Mistakes)

1: Ignoring Interest Rates

- “Paying the minimum on a 7% loan? You’re basically throwing money in a fire.”

- Fix: Always know your rates—attack the highest first.

2: Skipping Forgiveness Research

- “Federal loan borrowers: You might qualify for PSLF or income-driven forgiveness—don’t leave free money on the table!”

3: Only Paying the Minimum

- “This keeps you in debt for decades. Even $50 extra/month makes a difference.”

Read more about: 7 Smart Ways to Save Money While Paying Off Student Loans

5: Your Burning Student Loan Questions—Answered!

💡 Myth Buster: “There’s only one right way to pay off student loans.”

🔥 Truth: Hell no! The best strategy depends on your income, loan types, and goals. Let’s tackle your top questions.

❓ “Can I negotiate my student loan payments?”

✅ Yes—sometimes!

- Private lenders may lower your rate if you:

- Have good payment history

- Show proof of financial hardship

- Threaten to refinance elsewhere (they’ll often match rates!)

- Federal loans? No negotiation, but you can switch to income-driven plans for lower payments.

💡 Pro Tip: “Always ask—the worst they can say is no.”

❓ “Should I use my 401(k) to pay off student loans?”

🚨 NO! (Unless you love penalties and regret.)

- Why it’s bad:

- 10% early withdrawal penalty

- Lose compound growth (that 10Kcouldbe100K at retirement)

- Still owe taxes on the withdrawal

- Better option: Use side hustle cash instead.

❓ “What’s the fastest student loan repayment plan?”

🏆 The combo meal:

- Avalanche method (kill high-interest loans first)

- Refinance private loans (if rates are lower)

- Side hustles for extra payments

- Example: One reader paid off $80K in 3 years doing this!

❓ “Does loan forgiveness actually work?”

⚠️ It’s complicated.

- PSLF (Public Service Loan Forgiveness):

- Works if you qualify (gov/nonprofit jobs).

- But: 98% of applicants get rejected for dumb paperwork errors.

- IDR Forgiveness: After 20-25 years, but you’ll owe taxes on the forgiven amount.

🔍 Key Move: “Read the fine print and document EVERYTHING.”

❓ “How can I pay off $100K+ student loans?”

🎯 Game plan:

- Live like a student (rent cheap, drive a beater car).

- Aggressive income boosts (sales jobs, travel nursing, coding boot camps).

- Target $2K+/month payments.

- Real story: A nurse paid off $120K in 5 years working overtime + travel assignments.

6: Final Tips + Your Debt-Free Action Plan

🚦 3 Mindset Shifts to Stay Motivated

- “Progress > Perfection” (Even $50 extra/month helps!).

- “This is temporary” (2-5 years of hustle = decades of freedom).

- “You’re not alone” (44 million Americans are fighting this too).

🎯 Your 3-Step Starter Plan

- Pick ONE strategy today (e.g., set up biweekly payments).

- Cut ONE expense (Cancel Netflix? Pack lunches?).

- Boost income by $100/month (Sell old clothes? Do a freelance gig?).