1: Why Paying Off Your Auto Loan Early is a Smart Move 🚗💡

Most people think the best way to handle a car loan is to just stick to the monthly payments. But here’s the truth: paying off your auto loan early can save you a lot of money on interest and get you debt-free sooner. By using an auto loan payoff calculator, you can see how making extra payments can:

- Save you money on interest 💰

- Help you pay off your loan faster

- Free up cash for other goals (like building your savings or investing)

Ready to pay off your car loan early? It’s easier than you think with the right tools!

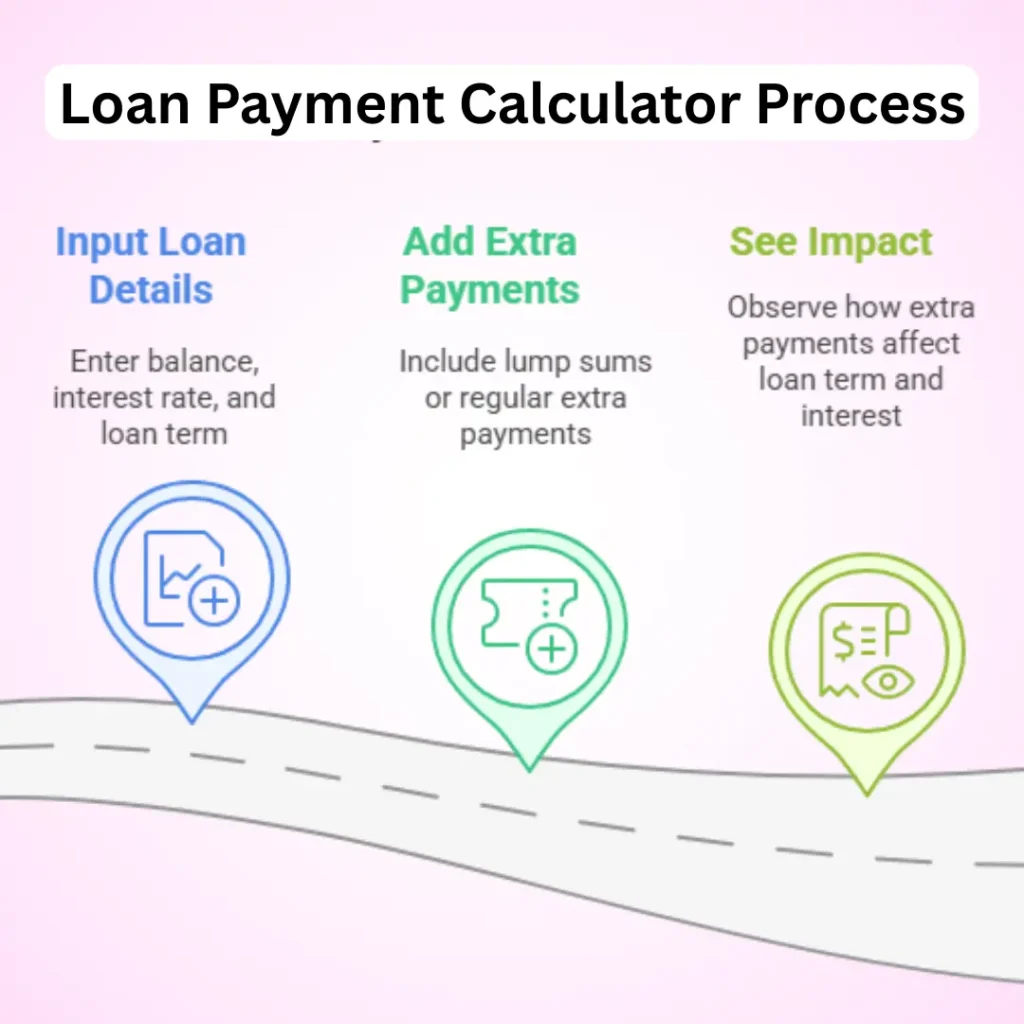

Section 2: How Does an Auto Loan Payoff Calculator Work? 🧮💡

An auto loan payoff calculator is a simple tool that helps you figure out how extra payments can speed up your loan payoff and save you money.

How It Works:

- Input your loan details: Balance, interest rate, loan term.

- Add extra payments: You can try one-time lump sums or regular extra payments.

- See the impact: The calculator shows how extra payments shorten your loan term and save on interest.

For example, if you add $100 to your monthly payment, you might pay off your loan months earlier and save hundreds of dollars in interest. 📉

The calculator gives you all the info you need to make smarter choices and reach your goal of being debt-free faster. 🚗💨

3: Why Use an Auto Loan Payoff Calculator? 🚀💰

Let’s clear up a common misconception: Some people think paying off an auto loan early isn’t worth it. But using an auto loan payoff calculator can save you money and get you debt-free faster! 🎯

3.1 Save on Interest 💸

The calculator shows how adding just a little extra to your monthly payment can save you hundreds of dollars in interest. For example, adding $100 per month could save you up to $900!

3.2 Pay Off Your Loan Sooner ⏱️

The payoff calculator shows you exactly how much quicker you can pay off your loan. For instance, adding $200 a month could shorten your loan by 18 months!

3.3 Track Your Progress 📊

See exactly how each payment gets you closer to your goal. The calculator keeps you motivated by showing your progress!

3.4 Customize Your Payments 🔧

You can experiment with different payment scenarios, whether it’s adding extra monthly payments or making lump-sum payments. It’s all up to you!

4: How to Use the Auto Loan Payoff Calculator (Step-by-Step Guide) 🧮📅

4.1 Step 1: Enter Your Loan Info 📜

Input your loan balance, interest rate, and loan term. For example, if you owe $15,000 at 6% interest with 36 months left, these are your starting points.

4.2 Step 2: Add Extra Payments 💥

Add extra payments to see how they impact your loan. Whether it’s a monthly boost of $100 or a lump sum, the calculator will show the results!

4.3 Step 3: Review Your Results 🔍

The calculator will show your new loan term, how much interest you’ll save, and when you’ll be debt-free. It’s all laid out for you!

4.4 Step 4: Adjust as Needed 🔄

You can always tweak your payments based on your budget and goals. It’s flexible and helps you stay on track.

5: Real-Life Scenarios: How Paying Off Your Auto Loan Early Can Save You Money 💸🚗

Many think paying off a car loan early is tough, but with the auto loan payoff calculator, you can save big and get out of debt faster! Here are two examples:

Example 1: Jane’s Story – Saving $1,500 in Interest! 😱

Jane added an extra $200 to her monthly payments. Result? She reduced her loan term by 2 years and saved $1,500 in interest. A small change with big savings!

Example 2: Mark’s Story – Cutting His Loan Term in Half! 🤑

Mark added just $50 more a month, cutting his loan term in half! He went from 36 months to 18 months, saving hundreds in interest. 💥

These examples show how small extra payments can help reduce your balance and save you money. The auto loan payoff calculator makes it easy to see how!

6: Common Mistakes to Avoid When Using an Auto Loan Payoff Calculator 🚫💡

Avoid these common mistakes when using the auto loan payoff calculator:

Mistake 1: Not Updating the Calculator 📅

If your loan terms change (like refinancing or an interest rate adjustment), update the calculator to get accurate results.

Mistake 2: Ignoring Early Payment Penalties ⚠️

Some loans have penalties for paying off early. Check for any penalties before making extra payments to ensure it’s worth it.

Mistake 3: Inconsistent Payments 📉

One-time extra payments won’t make as much of an impact as regular ones. Be consistent with extra payments to see the full benefit!

7: Alternatives to Using an Auto Loan Payoff Calculator 💡📊

While the auto loan payoff calculator is a great tool, there are alternatives like spreadsheets and budgeting apps:

1. Budgeting Spreadsheets 📈

Spreadsheets (like Excel or Google Sheets) let you manually track loan payments.

Pros: Customizable, free, detailed tracking.

Cons: Time-consuming, requires manual input.

2. Budgeting Apps 📱

Apps like Mint and YNAB can track loans and budgets.

Pros: Syncs with bank accounts, easy to use.

Cons: Some charge fees, not focused on loan calculations.

Why the Payoff Calculator Wins 🏆

An auto loan payoff calculator is more accurate and easy to use compared to spreadsheets or apps, saving you time and effort.

8: Frequently Asked Questions (FAQ) 🤔💬

1. How accurate is the auto loan payoff calculator? 🎯

It’s highly accurate when you input the correct loan details. Just make sure your data is up-to-date!

2. How often should I update my payment plan using the calculator? 🔄

Update whenever you make changes like extra payments or interest rate adjustments.

3. Do I need to refinance to pay off my car loan early? 💳

No, you can pay off your loan early without refinancing. Use the calculator to plan extra payments.

4. What’s the best strategy for paying off my auto loan early? 🏁

The best strategy is to make consistent extra payments. Use the calculator to see how small payments can help you save.

5. Can I use this tool for any type of car loan? 🚙

Yes, it works for all types of car loans—new, used, or lease buyout. Just enter your loan details.

9: Conclusion – Start Paying Off Your Loan Faster Today 🚗💨

You’ve learned how the auto loan payoff calculator can save you money, help you pay off your loan faster, and visualize the process. Why wait? With just a few simple steps, you can:

- Save money by reducing the interest you pay.

- Pay off your loan faster with manageable extra payments.

- See the impact of your extra payments clearly.

So, why not start today? Try the auto loan payoff calculator now and take control of your car loan! It’s quick, easy, and could save you thousands in the long run! 🎯

10: Call to Action (CTA) 📣

Now that you know how powerful the auto loan payoff calculator is, we’d love to hear from you! Have you tried the calculator yet? Share your results and any tips you’ve discovered in the comments below!👇

And if you found this guide helpful, share it with a friend who’s ready to tackle their car loan. Let’s spread the word and help more people pay off their loans faster! 🚗💪

Super-Duper website! I am loving it!! Will come back again. I am taking your feeds also.

I am just commenting to let you know what a notable discovery my cousin’s girl obtained going through your site. She even learned many issues, including what it is like to have a wonderful teaching style to let other individuals without difficulty comprehend various problematic matters. You actually surpassed her expectations. Many thanks for supplying such insightful, safe, revealing as well as unique tips about that topic to Tanya.