Buying your first car is exciting—until you realize you need a loan. No credit? No problem. Here’s how to get approved for your first time auto loan, even if you’re starting from zero

1. The Truth About Getting Your First Auto Loan

Let me guess – you’ve heard that getting approved for your first auto loan is nearly impossible without perfect credit? That’s total nonsense. The reality? Thousands of people just like you get approved for their first car loan every single day – even with no credit history at all.

I get why you might be nervous. Walking into a dealership or applying for financing when you’ve never done it before feels intimidating. What if they say no? Could you end up stuck with sky-high payments? What if you get taken advantage of?

What Lenders Don’t Tell You (But You Need to Know)

Here’s what most first-time buyers don’t realize:

- Lenders actually WANT to approve you (they make money off loans, remember?)

- There are special programs specifically for first-time borrowers

- Your lack of credit history isn’t necessarily a deal-breaker – they just need to see other signs you’re reliable

How First-Time Auto Loans Really Work

The key is understanding how the system works. Auto loans for first-time buyers operate a bit differently than standard car financing. Lenders know you’re new to this, so they look at other factors beyond just your credit score – things like:

- Your income and job stability – Can you actually afford the payments?

- Whether you can make a down payment – Shows you’re serious and reduces their risk

- If you have someone who can cosign – Adds a safety net if your credit is thin

Bottom line? That dream car isn’t out of reach. You just need the right strategy – and I’ll show you exactly how to make it happen.

2: First-Time Auto Loans Explained (No Finance Degree Required)

Alright, let’s break this down in plain English. A first-time auto loan is simply a car loan designed for people who’ve never financed a vehicle before. Think of it like training wheels for your credit history.

1. How Approval Works for First-Time Buyers

Here’s what makes it different from a regular auto loan:

Lenders understand you’re starting from scratch. Instead of demanding perfect credit, they might:

- Accept alternative credit history (like utility bills or rent payments)

- Focus more on your income and employment (steady job = lower risk)

- Require a cosigner if your credit is thin (a trusted person to back you up)

2. What to Expect With Rates & Terms

Yes, your interest rate might be higher than someone with established credit. But it’s not always the nightmare scenario people fear. Many first-time buyers get reasonable rates, especially if they:

- Make a solid down payment (10-20% is ideal)

- Choose a shorter loan term (36-60 months saves you money long-term)

- Get pre-approved before visiting dealers (gives you negotiating power)

3. Where to Get Your First Auto Loan

Almost every type of lender has options:

- Credit Unions: Often the most first-time-buyer friendly (better rates for members)

- Banks: Some have special “starter” auto loans (check local and national options)

- Online Lenders: Quick applications, but compare rates carefully (watch for fees)

- Dealerships: Convenient but watch for markup (they often add to interest rates)

Pro Tip: Don’t assume you won’t qualify. I’ve seen people with zero credit history get approved just because they had steady income and saved for a down payment. The system isn’t rigged against you – you just need to approach it the right way.

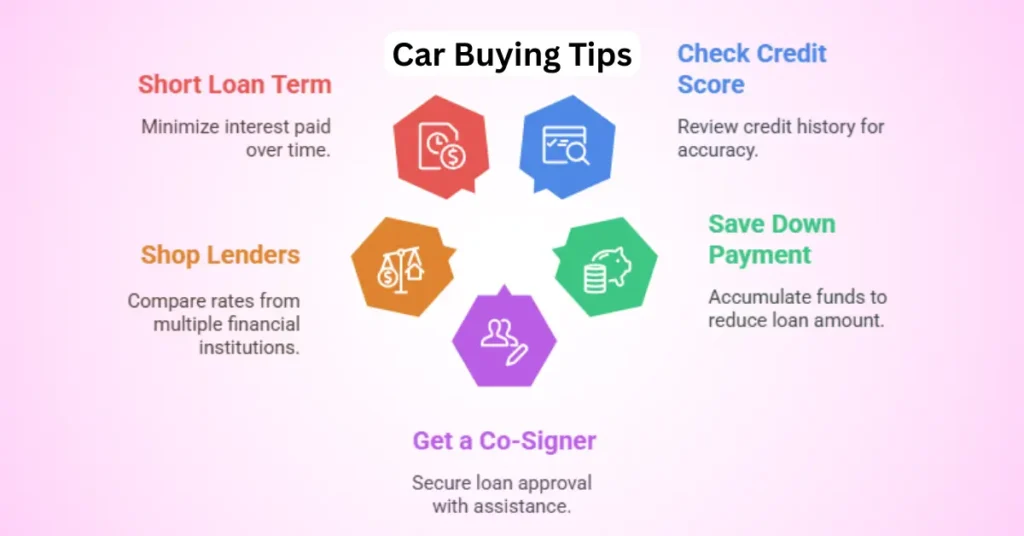

3: 5 Smart Tips to Get Your First Auto Loan Approved (Even With No Credit!)

Think you need perfect credit to get approved for your first auto loan? Think again. I’ve helped hundreds of first-time buyers get approved, and let me tell you – the secret isn’t in having spotless credit. It’s in working smarter with what you’ve got.

Here’s the real deal: lenders care more about reducing their risk than about your lack of credit history. Show them you’re worth betting on, and you’ll be driving off the lot in no time. These 5 insider tips will dramatically boost your approval chances:

3.1 Check Your Credit Score (Yes, Even If You Think You Don’t Have One)

Here’s something that surprises most first-time buyers: you might already have credit without realizing it. That cell phone bill? Your apartment lease? They could be building your credit right now.

Here’s what to do:

- Pull your reports from AnnualCreditReport.com (it’s free)

- Look for errors – about 1 in 5 reports have mistakes

- No credit at all? We’ll work with that (see tip #3)

3.2 Save for a Down Payment (Your Secret Weapon)

Want to instantly look better to lenders? Walk in with cash in hand. A solid down payment:

- Shows you’re serious

- Lowers the amount you need to borrow

- Can offset weaker credit

Aim for 10-20% if possible. For a 20,000car, that′s2,000-$4,000. Too steep? Some lenders accept less, but expect higher rates.

3.3 Get a Co-Signer (The Fastest Approval Hack)

This is the closest thing to a magic wand for first-time buyers. A co-signer with good credit can:

- Get you approved when you wouldn’t be otherwise

- Score you way better interest rates

- Help build your own credit

Just remember – they’re on the hook if you miss payments, so don’t take this lightly.

3.4 Shop Lenders Like a Pro (Dealers Aren’t Your Only Option)

Big mistake I see? Only applying at the dealership. Smart buyers:

- Get pre-approved from a credit union first (often best rates)

- Check online lenders for quick comparisons

- Use those approvals to negotiate better terms at dealers

3.5 Keep the Loan Term Short (Future You Will Thank You)

That 84-month loan might look tempting with its low payments, but here’s the ugly truth:

- You’ll pay WAY more in interest

- Risk being “upside down” (owing more than the car’s worth)

- Get stuck in a bad financial position

Stick to 60 months max – your wallet will thank you later.

Read more about: SECU Auto Loan Rates in 2024

4: First-Time Auto Loan Mistakes That Will Cost You (Avoid These!)

Most first-time auto loan guides tell you what to do. Let me tell you what NOT to do – because these mistakes can cost you thousands.

Mistake #1: Only Looking at Monthly Payments

Dealers love to focus on “what monthly payment can you afford?” It’s a trap. What matters more:

- The total price of the car

- The interest rate

- How long you’ll be paying

Mistake #2: Skipping the Pre-Approval Step

Walking into a dealer without pre-approval is like going to a poker game showing your cards. Get approved elsewhere first so you:

- Know your real budget

- Have leverage to negotiate

- Avoid dealer markup on financing

Mistake #3: Ignoring the Fine Print

That low rate might come with strings like:

- Mandatory expensive add-ons

- Prepayment penalties

- Balloon payments

Always read everything – twice.

Mistake #4: Financing Every Extra

Extended warranties? Fabric protection? Those almost always cost more than they’re worth when financed.

Mistake #5: Not Checking Insurance Costs First

That sweet sports car might be affordable until you get the insurance quote. Always check before you buy.

5: First-Time Auto Loan FAQs (Your Burning Questions Answered)

You’ve got questions. I’ve got real answers – no financial jargon, just straight talk about getting your first auto loan. Let’s bust some myths and get you the information you actually need.

Q1: “Can I really get a first-time auto loan without a job?”

Here’s the hard truth: lenders want to see income. But that doesn’t mean you need a traditional 9-to-5. What they’ll accept:

- Part-time work (if consistent)

- Freelance/1099 income (with proof)

- Disability or other regular benefits

- A co-signer with stable income

Q2: “What credit score do I actually need?”

The magic number is around 620 for decent rates, but here’s what most guides don’t tell you:

- Some lenders specialize in “thin file” borrowers

- Credit unions often have more flexible standards

- A bigger down payment can offset lower scores

Q3: “How much should I spend on my first car?”

The old “20% down, 48-month loan” rule is outdated. A better approach:

- Total car payment ≤ 15% of monthly take-home pay

- Include insurance in your budget

- Remember registration/taxes will add 5-10% to price

Q4: “Should I buy new or used for my first auto loan?”

Pros and cons:

- New cars: better rates but depreciate fast

- Used cars: more bang for buck but watch mileage

- CPO: Sweet spot with warranty protection

Q5: “What if I get denied?”

First, don’t panic. Next steps:

- Ask why (they have to tell you)

- Address the issue (credit, income, etc.)

- Wait 30 days before reapplying

- Consider alternative lenders

6: You’re Ready – Here’s What to Do Next (Action Plan)

Let’s cut to the chase – you now know more about first-time auto loans than 90% of buyers walking into dealerships. But knowledge is only power if you use it. Here’s your step-by-step game plan:

1. Gather Your Documents

- 2 most recent pay stubs

- Proof of residence (utility bill works)

- Driver’s license

- References (some lenders ask)

2. Get Pre-Approved

Do this BEFORE car shopping:

- Start with your bank/credit union

- Try 2-3 online lenders

- Compare all offers side-by-side

3. Find Your Car

- Stick to your pre-approved amount

- Get insurance quotes before committing

- Have a mechanic inspect used cars

4. Negotiate Like a Pro

- Focus on out-the-door price, not payments

- Walk away if pressured

- Sleep on any deal before signing

5. Make It Official

- Read every line before signing

- Get copies of all documents

- Set up payment reminders

Final Tip: Your first auto loan is just the beginning. Make all payments on time, and in 12-18 months you’ll qualify for much better terms. This is how you build credit the right way.