“Can you pay off a personal loan early? While it seems like a smart move, it could actually cost you money if you’re not careful.”

While eliminating debt faster can save you interest, many lenders charge sneaky prepayment penalties (typically 2-5% of your remaining balance) that might wipe out your savings – the key is checking your loan terms, comparing potential fees against interest savings, and deciding if early payoff actually benefits your unique financial situation.

Can You Pay Off a Personal Loan Early? (The Straight Answer)

Short answer? Yes… but with a big “it depends.”

Most lenders allow early repayment—after all, they get their money back faster. But here’s the catch: some slap you with prepayment penalties to make up for lost interest. Sneaky, right?

Here’s What You Need to Check:

- Your Loan Agreement

- Flip through the fine print (I know, boring, but crucial).

- Look for phrases like “prepayment penalty” or “early repayment fee.”

- Some loans charge 2-5% of the remaining balance if you pay early. Ouch.

- Lender Policies

- Big banks? More likely to have fees.

- Online lenders? Often more flexible.

- Credit unions? Usually the most forgiving.

- How Early Is Too Early?

- Some loans only penalize you if you pay off within the first 2-3 years.

- Others don’t care—pay anytime, no extra cost.

What Happens If You Pay Early?

- Good scenario: You save hundreds (or thousands) in interest.

- Bad scenario: You get hit with a fee that wipes out your savings.

- Credit impact: Closing a loan can ding your score short-term (but long-term, it helps).

Bottom Line:

- If your loan has no prepayment penalty? Go for it!

- If it does? Crunch the numbers first. (“How much can I save by paying early?”)

Pros of Paying Off a Personal Loan Early (Why It’s Awesome)

“Think paying off your personal loan early is just about saving a few bucks on interest? Think again—the benefits go way deeper than that.”

Most people focus only on the interest savings (which is great), but knocking out your loan early does some serious heavy lifting for your finances. Let’s break down why ditching that debt ahead of schedule might be one of your smartest money moves.

1. Slash Interest Costs (The Obvious Win)

Every extra payment you make chips away at the principal balance, meaning less interest piles up over time. Even an extra $50/month can shave months (or years!) off your loan term.

- Example: A 10,000loanat102,748 in interest. Pay it off in 3 years? You’d save $1,000+. (“reduce interest by paying loan early”)

2. Boost Your Credit Score (Surprise Perk)

- Lower credit utilization (if it’s your only installment loan).

- Shows lenders you’re reliable (closed accounts in good standing stay on your report for 10 years).

- Just know: Your score might dip temporarily when the account closes (“does paying off a personal loan early hurt credit”).

3. Free Up Cash Flow (Hello, Breathing Room!)

No more monthly payments = extra money to:

- Build emergency savings.

- Invest (hello, compound interest!).

- Tackle other debts (“best strategies to pay off a personal loan faster”).

4. Peace of Mind (Priceless)

Debt weighs on your mental health. Crushing it early? That’s financial therapy.

Bottom Line: If your loan has no prepayment penalty, paying early is a no-brainer for saving money and stress.

Cons of Paying Off Early (The Fine Print)

“Wait—paying off debt early could be BAD? Yep, and here’s when it backfires.”

Everyone assumes early payoff = automatic win. But some lenders rig the game with fees, and your cash might do more good elsewhere. Let’s expose the hidden downsides.

1. Prepayment Penalties (The Sneaky Fee)

Some lenders charge 2-5% of your remaining balance if you pay early. Example:

- Owe 5,000?That’sa100–250 penalty (“how to avoid prepayment penalties”).

- Always check your loan agreement before throwing extra money at it.

2. Opportunity Cost (Your Money Could Work Harder)

That extra $5,000 could:

- Earn 7–10% annually in the stock market (vs. saving maybe 5–15% on loan interest).

- Cover a career-boosting course or emergency fund.

- “Should I pay off my loan early or invest?” Depends on your loan’s interest rate!

3. Credit Score Dip (Temporary but Annoying)

Closing an installment loan can:

- Short-term: Drop your score 5–20 points (fewer active accounts).

- Long-term: Still helps—but don’t do it right before applying for a mortgage!

4. When It’s a Bad Idea

- High-interest debt? Pay that first (credit cards > personal loans).

- No emergency fund? Build that before attacking low-interest debt.

Bottom Line: Early payoff isn’t always the hero move. Weigh penalties, alternatives, and your full financial picture (“when NOT to pay off a loan early”).

Related: How Many Personal Loans Can You Have at Once

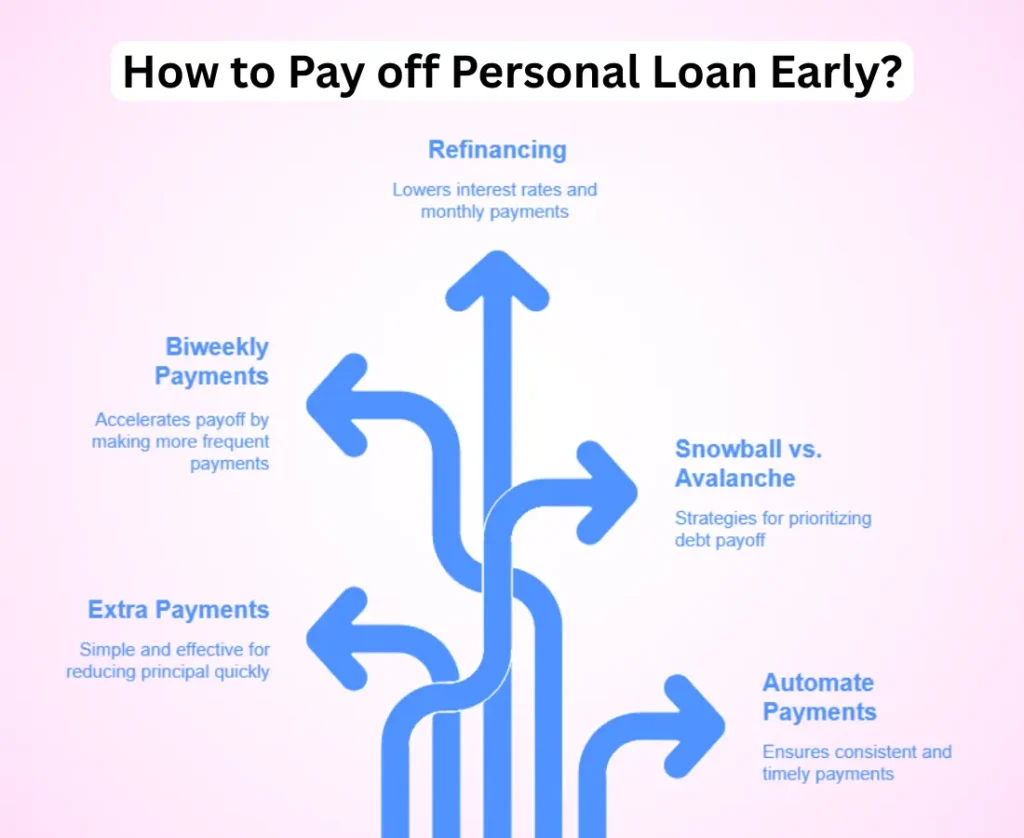

How to Pay Off a Personal Loan Early (Smart Strategies)

“Think paying off your loan early just means throwing extra cash at it whenever you can? There’s actually a science to doing it right.”

Most people assume any extra payment helps – and while that’s technically true, there are smarter ways to maximize your savings and minimize headaches. Let me show you the real strategies that financial pros use (without the confusing jargon).

1. The Extra Payment Hack (Simple But Powerful)

- Round up your payments: If your payment is 287,makeit300

- Add windfalls: Tax refunds, bonuses, or side hustle cash

- Pro tip: Always specify “apply to principal” with your lender (“paying extra on personal loan”)

2. Biweekly Payments (The Ninja Move)

Instead of monthly payments:

- Split payment in half, pay every 2 weeks

- Result: 13 full payments/year instead of 12

- Cuts years off your loan (“biweekly payments to pay loan faster”)

3. Refinancing (When It Makes Sense)

Consider if:

- Rates dropped since you got the loan

- You can get better terms (no prepayment penalty)

- Watch out: Closing costs might eat into savings (“refinance to pay off personal loan early”)

4. The Snowball vs. Avalanche Debate

- Snowball: Pay smallest debts first (psychological wins)

- Avalanche: Pay highest-interest debts first (saves more money)

- For personal loans: Avalanche usually wins (“best strategies to pay off a personal loan faster”)

5. Automate to Win

Set up:

- Automatic extra payments (even $25/week adds up)

- Direct deposit splits (send part of paycheck directly to loan)

Real Talk: The best method is the one you’ll actually stick with. Even an extra $50/month can shave off 6+ months of payments.

FAQs (Quick Answers to Real Questions)

“Let’s cut to the chase – here are the no-BS answers to what people actually want to know about early loan payoff.”

1. Does early payoff hurt my credit?

Maybe a tiny, temporary dip (5-15 points), but long-term it helps. Unless it’s your only installment loan.

2. Which lenders allow penalty-free early payoff?

Most credit unions and online lenders (like SoFi). Always check your contract first.

3. Pay off loan or invest?

If loan interest > investment returns: Pay loan. Otherwise: Invest. But debt freedom feels amazing.

4. How much will I really save?

Use an early payoff calculator. 10kloanat101,000.

5. What’s the hidden catch?

Some lenders:

- Apply extra payments to future interest first

- Remove auto-pay discounts

- Charge “soft” penalties like lost rate benefits

Bottom line: The math matters, but so does your peace of mind. Run your numbers, then decide.

Wrapping up

“Here’s the truth about paying off your personal loan early: It’s not about right or wrong—it’s about what works for YOUR money.”

If your loan has no prepayment penalty and you’ve got emergency savings covered, go for it—you’ll save on interest and gain peace of mind. But if fees would wipe out your savings or you have higher-interest debt, focus there first. Either way, check your loan terms, run the numbers, and decide what moves your financial future forward. Smart choices beat rigid rules every time.