“Think getting a construction loan is as simple as a regular mortgage? Think again.” If you’re wondering how do construction loans work, here’s the key difference: unlike traditional mortgages, where you get all the money upfront, construction financing releases funds in carefully controlled phases—and if you don’t understand this process, you could face serious roadblocks. But here’s the good news: this guide will walk you through exactly how construction loans work, from the unique approval process to those crucial draw payments, so you can navigate your home build with confidence (and avoid those “why didn’t anyone tell me this?” moments). Let’s dive in and demystify the process together.

What Is a Construction Loan? (The Simple Explanation)

Let’s start with the basics. A construction loan is a short-term loan (usually 6-18 months) that covers the cost of building your home. But here’s the kicker: you don’t get all the money at once. Instead, the lender pays out funds in stages—called “draws”—as construction progresses.

How Is This Different From a Regular Mortgage?

With a traditional mortgage, you buy an existing home, get the full loan amount at closing, and start making payments immediately. A construction loan is more like a line of credit:

- You only pay interest on the amount you’ve drawn (so if you’ve used

- 50Koutofa

- 50Koutofa300K loan, you’re only charged interest on $50K).

- Funds are released after inspections—meaning the lender checks the work before giving you the next chunk of cash.

- Once construction is done, you’ll typically refinance into a permanent mortgage (unless you have a construction-to-permanent loan, which we’ll cover later).

The 3 Main Types of Construction Loans

- Construction-to-Permanent Loans

- AKA “single-close loans.”

- You get one loan that covers both the build and the mortgage afterward.

- Best for: People who want to avoid applying for financing twice.

- Stand-Alone Construction Loans

- Only covers the build phase.

- You’ll need to get a separate mortgage once construction is done.

- Best for: Those who want more flexibility in choosing their long-term lender.

- Owner-Builder Loans

- For people acting as their own general contractor.

- Harder to qualify (lenders see DIY builds as riskier).

- Best for: Experienced builders with construction know-how.

Why Would Someone Choose a Construction Loan?

Simple—you can’t get a traditional mortgage for a house that doesn’t exist yet. If you’re:

✔ Building a custom home (no cookie-cutter floor plans here).

✔ Doing a major renovation (like adding a second story).

✔ Buying land + building from scratch.

Related: 5 Secrets Your VA Home Loan Payment Calculator

How Do Construction Loans Work? (The Step-by-Step Breakdown)

Most people think construction loans are just like regular mortgages – you get approved, get your money, and start building. Nope. The reality? You’re entering a carefully controlled process where every nail and 2×4 gets scrutinized before you see a dime. Let’s walk through exactly how this works so you’re not blindsided.

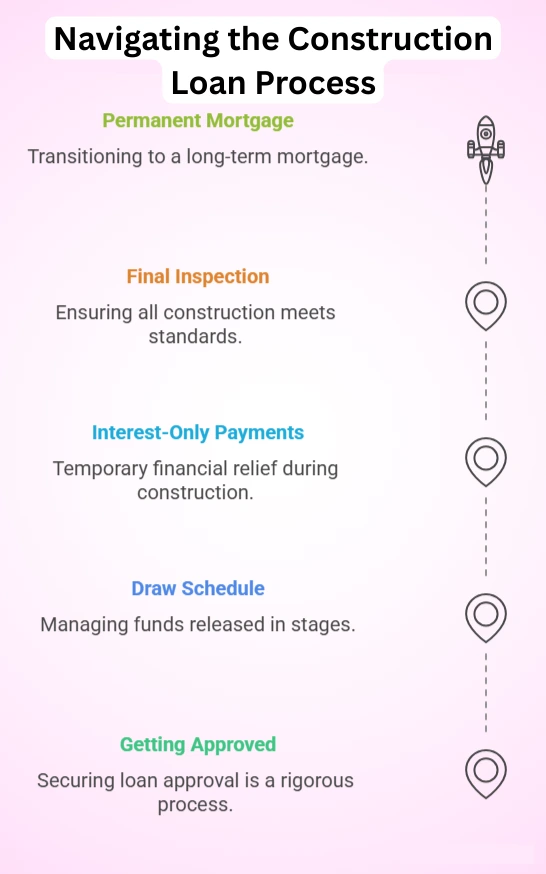

The 5-Step Construction Loan Process

1: Getting Approved (It’s Tougher Than You Think)

- Lenders don’t just look at your credit score (though you’ll typically need 680+).

- They want to see:

- Detailed construction plans (architect-approved blueprints)

- A realistic budget (with 10-15% buffer for surprises)

- A qualified builder (with proven experience)

- Pro Tip: Get pre-approved before shopping for land or builders.

2: The Draw Schedule – Your Money Comes in Chunks

- Unlike a mortgage where you get all funds at closing, construction loans use “draws”:

- Foundation poured? First draw.

- Framing up? Second draw.

- Roof on? Third draw.

- Each stage requires an inspection before funds release.

3: Interest-Only Payments (The Temporary Relief)

- You only pay interest on what you’ve drawn (not the full loan amount).

- Example: If you’ve used

- 100Kofa

- 100Kofa400K loan, you only pay interest on $100K.

4: The Final Inspection (Don’t Celebrate Yet)

- Before converting to permanent financing:

- Certificate of Occupancy must be issued

- Final appraisal confirms home value

- Any punch list items completed

5: Transition to Permanent Mortgage

- With construction-to-perm loans: Automatic conversion

- Stand-alone loans: You’ll need to qualify for a new mortgage

Construction Loan FAQs (Answering Your Real Questions)

Here are the quick, no-fluff answers to your most pressing construction loan questions:

- Can I get a construction loan without a contractor?

*Yes, but only with an owner-builder loan (harder to qualify for, requiring 25-30% down and construction experience).* - What’s the difference between a construction loan and a regular mortgage?

Construction loans are short-term, interest-only, and paid in stages, while mortgages provide a lump sum upfront for existing homes. - How does the draw process work?

*Funds are released in phases (draws) after inspections confirm completed work, usually 5-7 times during construction.* - Are construction loan rates higher than traditional mortgages?

*Yes, typically 1-2% higher due to the increased risk for lenders.* - What happens if I go over budget?

You’ll need to cover the extra costs yourself—either from savings, reducing project scope, or pausing construction. - How long does approval take?

*Usually 30-45 days, but delays happen if plans, permits, or builder qualifications aren’t ready.*

Your Action Plan

Construction loans might seem daunting, but with the right prep, you can build your dream home without the financial stress. Start by gathering all your documents (financials, blueprints, and builder contracts), then shop lenders strategically—comparing at least 3-5 options for the best rates and terms. Most importantly, build buffers everywhere: pad your timeline by 3-6 months, set aside at least 10% extra in your budget, and get pre-approved before you even look at land. Yes, it’s work—but when you’re unlocking the door to a home designed exactly for you, every bit of hassle will be worth it. Ready to begin? Pull your credit reports, interview builders, and talk to lenders today. Your dream build is closer than you think.