🚗💰1. Introduction: Why Auto Loan Refinancing Matters?

Think you’re stuck with high car payments? Think again! Many people overpay on their auto loans simply because they don’t realize they can refinance and save money. We have discussed “auto loan refinance calculator” in this article.

If you’ve ever wondered, “Am I paying too much for my car loan?”—chances are, you are! Refinancing lets you:

Lower your monthly payments

Reduce interest costs

Adjust your loan term to fit your budget

But how do you know if refinancing is worth it? That’s where an Auto Loan Refinance Calculator comes in!

📊2. What is an Auto Loan Refinance Calculator & How Does It Work?

An auto loan refinance calculator effortlessly helps you estimate how much you could save by refinancing. Instead of struggling with complex math, just enter a few details, and instantly see your potential savings!

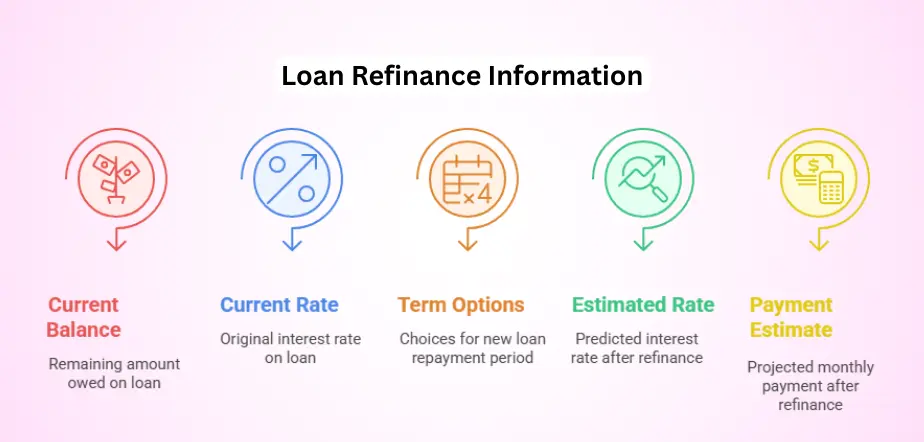

🛠️ How It Works

To use the calculator, simply input:

🔢 Current Loan Balance – What you still owe

📉 Current Interest Rate – Your current loan rate

📆 New Loan Term Options – Choose shorter or longer payments

💲 Estimated New Interest Rate – Expected refinance rate

💰 Monthly Payment Estimate – See how your new payment compares

🎯 Example:

A $25,000 loan at 8% for 5 years compared to a refinanced loan at 4% could save you hundreds or even thousands over time. With just a quick calculation, the calculator shows exactly how much!

Ready to check your savings? Try an Auto Loan Refinance Calculator today! 🚗💰

🚗💡3. Why Use an Auto Loan Refinance Calculator?

Think refinancing is complicated? Not at all! An auto loan refinance calculator helps you see if refinancing is a smart move—before you commit. Here’s why it’s a must-use tool:

1. Instant Savings Check – Want to know how much you can save? With just a few clicks, quickly see your potential interest and monthly payment savings.

2. Compare Loan Offers – Instead of relying on guesswork, easily find the best car loan refinance rates tailored to your needs.

3. Plan Your Budget – Whether you’re looking to lower your monthly payments or pay off your loan faster, adjusting loan terms helps you stay in control.

4. Stop Overpaying – Don’t let high-interest rates eat into your budget! Take action now to cut unnecessary costs and start saving.

💸4. How Much Can You Save? (Example Calculation)

Wondering if refinancing is worth it? Let’s break it down:

📌 Current Loan: $20,000 at 8% interest (5-year term) → $400/month

📌 New Refinance Rate: 4% interest (same term) → $370/month

💰 Monthly Savings: $30

💸 Total Savings Over 5 Years: $1,800

That’s nearly $2,000 back in your pocket! 🎉 Imagine the savings if you secure an even lower rate. 🚀

🚦5. Best Time to Refinance a Car Loan

Think refinancing is only for those struggling with payments? Wrong! The best time is when you can get a better deal. Here’s when to consider it:

Interest Rates Have Dropped 📉 – Lower rates mean lower payments.

Your Credit Score Improved 🔥 – A higher score gets better loan terms.

You Need Lower Payments 💰 – Refinancing can reduce your monthly bill.

Your Current Loan is Costly ⚠️ – Escape high fees and bad terms.

📜6. Easy Steps to Refinance Your Auto Loan

🔍 Step 1: Check your loan balance, interest rate, and term.

🖩 Step 2: Use a car loan refinance calculator to see potential savings.

🏦 Step 3: Compare lenders for the best refinance rates.

📑 Step 4: Apply with necessary documents.

✍️ Step 5: Finalize new terms and start saving! 🚀

🚗💼7. Best Banks & Credit Unions for Auto Loan Refinancing in 2025

Finding the right lender can help you save money and secure better loan terms. Here are some top picks for auto loan refinancing in 2025:

Bank of America – Competitive rates, flexible terms, easy online application.

Consumers Credit Union – Low refinance rates, no prepayment penalties, open membership.

Navy Federal Credit Union – Great for military members, long loan terms, no fees.

LendingClub – Specializes in auto refinancing, competitive rates, simple online process.

Capital One – Pre-qualification without credit impact, flexible loan options.

Digital Federal Credit Union (DCU) – Low rates, no penalties, quick online process.

LightStream – Best for excellent credit, no fees, fast approvals.

Autopay – Marketplace for comparing multiple lenders, flexible terms.

Caribou – Personalized rates, hassle-free process.

MyAutoloan – Multiple offers in minutes, competitive rates.

📌 Always compare rates and terms before choosing a lender to maximize your savings!

⚖️8. Pros & Cons of Refinancing a Car Loan

Before refinancing, consider both the benefits and drawbacks:

✅ Pros:

- Lower Monthly Payments – A lower rate reduces your payment, freeing up cash.

- Reduced Interest Costs – Pay less interest over time, saving thousands.

- Flexible Loan Terms – Adjust terms to match your budget and financial goals.

- Better Cash Flow – Lower payments mean more financial flexibility.

⚠️ Cons:

- Refinance Fees – Some lenders charge fees that could eat into your savings.

- Extended Loan Term – Lower payments might mean paying more interest in the long run.

- Credit Score Impact – A hard inquiry may temporarily lower your credit score.

📌 Weigh these factors carefully to decide if refinancing is right for you! 🚗💰

🚗💳9. How to Qualify for Auto Loan Refinancing

Think you need perfect credit to refinance? Not true! While a good credit score helps, lenders consider other factors too.

✅ What Lenders Look For:

Good Credit Score – 670+ is ideal, but some lenders accept lower scores.

Stable Income – Proof you can afford the new loan.

Current Loan Status – Must be in good standing (no recent missed payments).

❓ Can You Refinance with Bad Credit?

Yes! Try:

Improving your credit score.

Applying with a co-signer for better terms.

Finding bad credit refinance lenders.

Choosing a lender that considers income stability.

🖥️10. Online Auto Loan Refinance: How to Apply Easily?

Think refinancing takes forever? Not anymore! Online lenders make it quick and hassle-free.

💻 Where to Apply for Fast Approval

Check LightStream, Autopay, MyAutoLoan, and Caribou for instant pre-qualification.

🌐 Why Choose Online Lenders?

Fast Approvals – Get loan offers in minutes.

Compare Rates – Find the best deal easily.

Apply from Home – Skip the bank visits.

No Pressure – Review offers at your pace.

Documents You’ll Need:

ID Proof (Driver’s license, passport)

Income Proof (Pay stubs, tax returns)

Current Loan Details (Balance, rate)

Vehicle Info (VIN, make, model, mileage)

📌 Pro Tip: Double-check all details before applying! 🚗💨

🚘💡11. FAQs About Auto Loan Refinancing

Think refinancing is too complicated? It’s easier than you think! Let’s clear up some common questions.

❓ How Does an Auto Refinance Calculator Estimate Savings?

It factors in:

Current loan balance & interest rate 📊

New refinance rate & loan term 🏦

Potential monthly payment & savings 💰

❓ Does Refinancing Affect My Credit Score?

Hard inquiry may lower your score slightly.

️ On-time payments can improve it!

New loan account may cause a temporary dip.

❓ Is It Better to Refinance or Pay Off Early?

✅ Refinance for lower payments & better rates.

✅ Pay off early to save on interest if you can afford it.

❓ Can I Refinance Without a Credit Check?

Most lenders require a credit check, but some offer soft pull pre-qualification (no impact on your score!).

❓ How Do I Use an Online Refinance Calculator?

1️⃣ Enter current loan details 📊

2️⃣ Add new rate & term 🏦

3️⃣ Click calculate & see your savings! 💰

🔚12. Conclusion: Is Refinancing Right for You?

Refinancing a car loan isn’t for everyone, but if you can lower your interest rate, reduce monthly payments, or save money over time, it’s definitely worth considering!

🔑 Key Takeaways:

Use an auto loan refinance calculator to check savings.

Compare multiple lenders for the best refinance rates.

Weigh the pros and cons before making a decision.

🚀 Ready to save money? Use our Auto Loan Refinance Calculator now and start lowering your car payments today! 🔽🔽