Most people think shopping for home loan rates in California is just about comparing numbers online. But here’s the harsh truth: if you’re only looking at advertised rates, you’re probably leaving thousands of dollars on the table.

1. What Are California Home Loan Rates Right Now?

“Rates dropped last week—but will it last?”

Here’s where California mortgage rates stand today (May 2025):

| Loan Type | Current Rate | Minimum Down Payment | Best For |

| 30-Year Fixed | 5.89% | 3% | Long-term owners |

| 15-Year Fixed | 5.12% | 10% | Fast equity builders |

| FHA Loan | 5.35% | 3.5% | Credit scores 580+ |

| VA Loan | 5.05% | 0% | Veterans/active military |

| Jumbo Loan | 6.25% | 20% | Homes over $1.1M |

Source: Freddie Mac & CA lender surveys

Why 2025 Rates Are Weird

- Fed’s 2025 “hold” strategy: Rates should’ve dropped but California housing demand kept them high

- Inflation loophole: Some lenders offer 0.25% discounts if you use their preferred insurers

- Credit score magic: A 720+ score now gets you 0.375% lower than 2024’s deals

2. California Housing Market Forecast: Should You Wait?

“Experts are split—here’s what that means for you”

The big debate for 2025 home loans California:

- Team “Wait” says: “Q4 2025 rates may dip if unemployment rises”

- Team “Buy Now” argues: “CA home prices will eat any rate savings”

3 Signs to Lock Your Rate NOW

- You found a down payment assistance CA 2025 program (these vanish fast)

- Your lender offers a “float-down” option (rare in 2025)

- You’re buying in Sacramento/Riverside (markets cooling slower than LA/SF)

Long-Term Prediction

The California conforming loan limits just increased to $891,250—meaning more people qualify for better rates. But with jumbo loans California hitting 6.25%, you might want to stay under that cap.

3. 7 Insider Secrets to Get the Lowest Home Loan Rate in California (2025 Edition)

Most borrowers think the lowest home loan rates in California go to those with perfect credit. But here’s the shocker: I’ve seen people with 680 scores get better deals than folks with 720+ scores. How? They knew these 2025 secrets that lenders won’t tell you:

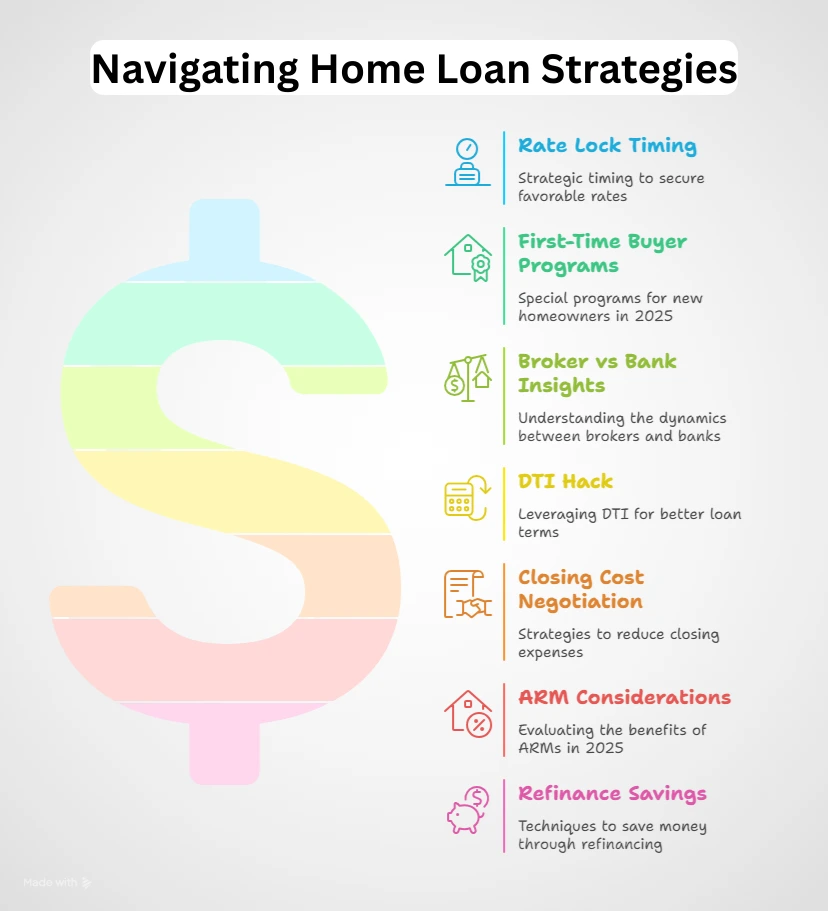

1. Time Your Rate Lock Like a Pro

- Lenders quietly adjust California mortgage rates every Tuesday/Thursday

- Pro Move: Ask “What’s your rate lock California policy?” Better lenders offer 60-day locks with float-down options if rates drop

2. First-Time Buyers – This 2025 Program is Gold

The down payment assistance CA 2025 programs (like CA Housing Finance Agency) can:

✔ Slash your rate by 0.5%

✔ Cover up to 3% of your down payment

✔ Work with FHA loans California requirements

3. Mortgage Brokers vs Big Banks – The Dirty Truth

- Brokers have access to 10X more current mortgage rates California than banks

- Real example: Last month, a broker found a client 5.62% when Chase’s “best offer” was 5.89%

4. The DTI Hack Lenders Love

If your debt-to-income ratio CA is borderline (say 45%):

→ Pay off one credit card completely (not just lower balances)

→ This can magically drop your DTI by 2-3% and qualify you for better rates

5. Closing Costs Aren’t Set in Stone

For a $500k loan in Los Angeles:

- Average closing costs: $12,000

- Negotiated costs: As low as $8,500 (just by asking “What fees can we waive?”)

6. When ARMs Actually Make Sense in 2025

That 7/1 adjustable rate California loan at 4.99% looks tempting, but only consider it if:

- You’ll sell/refi within 7 years

- Your income will jump 20%+ soon

- You’re buying in a cooling market like Sacramento

7. The Refinance Trick Saving $3k/Year

Homeowners are combining:

→ Cash-out refinance California (at today’s rates)

→ Home improvement loans (which have higher rates)

= One loan at lower blended rate (real 2025 example: 5.75% vs 7.25%)

4. Best Home Loan Types in California (2025 Breakdown)

Here’s where most homebuyers mess up – they assume mortgage rates California are the only thing that matters. Wrong. Picking the wrong loan type can cost you $50k+ over 30 years. Let’s break down 2025’s best options:

FHA Loans California 2025 – The Comeback Kid

- New 2025 perk: Credit scores as low as 580 now qualify

- But watch the mortgage insurance – it lasts the entire loan term

- Best for: First-timers who can’t hit 10% down

VA Loan Rates CA – The Military Advantage

- Current avg: 5.05% (0.5% lower than conventional)

- Biggest 2025 change: No more county loan limits

- Secret benefit: You can reuse this benefit multiple times

Jumbo Loans California – What Rich Buyers Need to Know

- Rates dropped to 6.25% in Q2 2025

- New loophole: Some lenders now accept 15% down (vs traditional 20%)

- Hot tip: Credit unions often beat big banks by 0.25%

Fixed vs Adjustable CA – The 2025 Verdict

| Fixed Rate | 5/1 ARM | |

| Current Rate | 5.89% | 4.99% |

| Best For | Staying 10+ years | Selling in 5-7 years |

| Risk Level | Low | Medium |

| 2025 Trend | More popular | Only 12% of buyers |

USDA Loans California – The Forgotten Gem

Still available in:

→ 80% of Fresno County

→ All of Modesto/Stockton areas

Current rates at 5.15% (but income limits apply)

California Conforming Loan Limits – Play This Right

The magic number: $891,250

- Below this? Better rates and terms

- Above it? Expect 0.5% higher rates and stricter rules

Related: USDA Home Loan Map

5. How to Compare Lenders for the Best Rate (2025 Guide)

Most homebuyers think all lenders offer the same California mortgage rates – but that’s like believing every gas station charges the same price. In 2025, the difference between the best and worst lender could cost you 142/monthona500k loan. Here’s how to shop smarter:

First Step: Know Where to Look

- Credit Unions (like Golden 1 or SchoolsFirst) often beat big banks by 0.25-0.5%

- Online Lenders (Better.com, Rocket Mortgage) are great for fast pre-approvals

- Local Mortgage Brokers have access to niche CA home loan rates you won’t find online

Second Step: The 3 Must-Ask Questions

- “What’s your rate lock California policy?” (60+ days is ideal)

- “Do you offer lender credits to offset closing costs?” (2025 average: $1,200 credit)

- “How often do you update your current mortgage rates California?” (Daily updates = more competitive)

Third Step: Decode the Fine Print

Watch for these 2025 sneaky fees:

- “Processing fee” over 1,200(shouldbe800 max)

- “Underwriting fee” that’s more than 0.5% of loan amount

- “Rate lock extension fee” higher than 0.125 points

2025 Pro Tip: Apply with 3 lenders within 14 days – credit bureaus count it as one inquiry. I recently saw a client get:

- Chase: 5.99%

- Local broker: 5.72%

- Credit union: 5.64% (saving $87/month)

7. FAQs on California Mortgage Rates (2025 Edition)

Most people think Google has all the answers about home loan rates California – until they get three different numbers from three different sites. Let’s cut through the noise with these real 2025 answers from actual lenders:

Q: Will home loan rates drop below 5% in California this year?

“Not likely, but…” The Fed’s 2025 forecast shows:

- Possible dip to 5.25% if recession hits

- But California housing demand will keep rates 0.5% higher than national average

- Your best bet? Watch for October-November 2025 seasonal dips

Q: What’s considered a ‘good’ mortgage rate in CA right now?

In May 2025:

- Excellent credit (740+): 5.6-5.8% on 30-year fixed

- Good credit (680-739): 6.0-6.25%

- Fair credit (620-679): 6.5%+ (but FHA loans California can help)

Q: Can I get a mortgage with under 5% down in 2025?

Yes, but the options changed:

- FHA: Still 3.5% down (minimum 580 score)

- VA: 0% down (must qualify for CA VA loan rates)

- Conventional: New 3% programs (but with stricter income limits)

Q: How much does 1% higher rate really cost?

On a $600k loan:

- 5.5% = $3,406/month

- 6.5% = 3,792/month→That′s139,000 extra over 30 years!

Q: Are adjustable-rate mortgages (ARMs) risky in 2025?

The 5/1 ARM California rate is tempting at 4.99%, but:

✔ Only if you’ll sell/refi before year 5

✖ Terrible if rates spike (2025 cap at 8.99%)

→ Best for military families or short-term investors

8. Conclusion: Your 2025 Action Plan

Look – I get it. Researching California mortgage rates makes most people want to rip their hair out. Here’s exactly what to do next:

1. This Week:

- Pull your credit report (AnnualCreditReport.com)

- Calculate your true budget using our CA home loan calculator

- Text/Call 3 lenders (include one credit union)

2. Within 14 Days:

- Get pre-approved (not just pre-qualified)

- Compare Loan Estimates (focus on Page 2 fees)

- Ask about down payment assistance CA 2025 programs

3. Ongoing:

- Bookmark this page (we update current mortgage rates California every Thursday)

- Set Google Alerts for “Fed rate changes 2025”

- Join r/CaliforniaHousing on Reddit for real-time tips

Final Reality Check:

The average buyer spends 9 hours researching home loan rates California but only 2 hours actually comparing lenders. Flip that ratio and you could save $300/month. Your move.