1. Introduction: The Benefits of Prequalifying for an Auto Loan.

Most people think that completing an auto loan starts working from the dealership, but this is a very expensive mistake! ❌ If you are unaware of the eligibility requirements for the loan, it is quite possible that you might face denial or substantial interest charges.

In auto loans, prequalification has changed the game as it allows consumers to access a loan estimate before checking their credit score. This is vital because it allows consumers to know what to expect when shopping for a car.

What Are the Benefits of Prequalifying?

It does not affect your credit score since it is a soft inquiry.

Knowing your budget beforehand will help to manage any overspending.

Better terms of the loan; you can shop around to get the best offer from different lenders.

Faster clearance procedure; there are no dealership surprises towards the end of the process.

2: What Does It Mean to Pre-Qualify for an Auto Loan?

Think of pre-qualifying as a preview of the auto loan that you could receive. It offers an estimate of the loan amount and interest rates available based on the provided information, and there is no hard credit check needed.

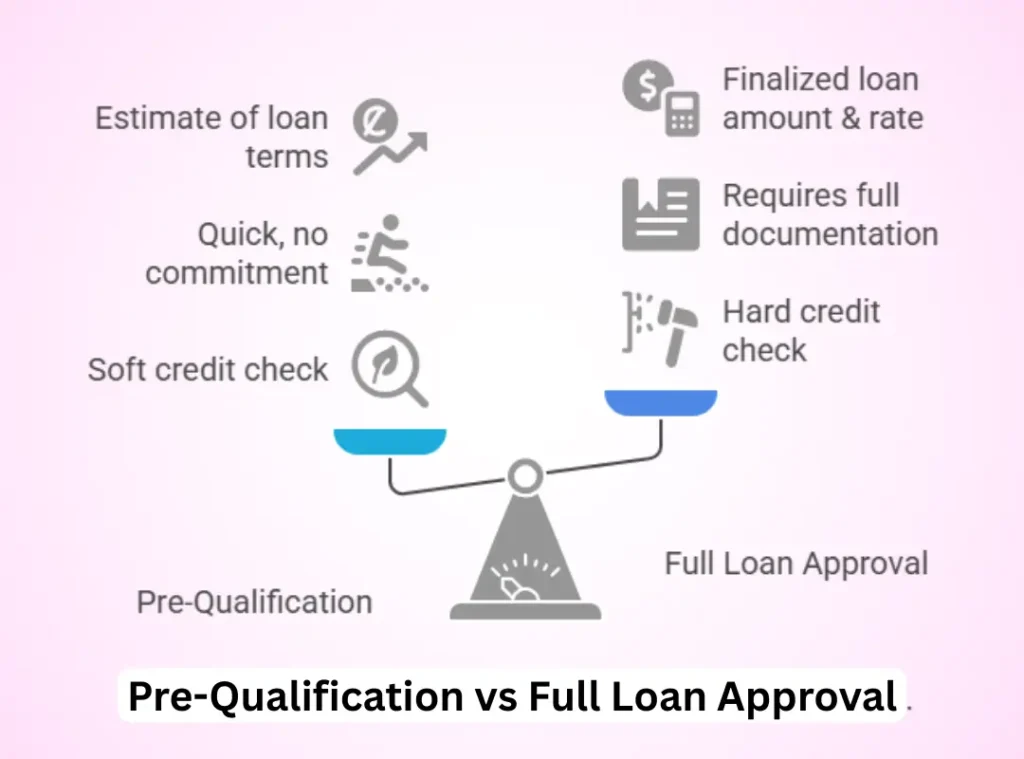

🔹 Pre-Qualification vs. Full Loan Approval

| Pre-Qualification | Full Loan Approval |

| ✅ Soft credit check (no impact) | ❌ Hard credit check (affects score) |

| ✅ Quick, no commitment | ❌ Requires full documentation |

| ✅ Estimate of loan terms | ❌ Finalized loan amount & rate |

🔹 How It Works

Lenders check:

📌 Your credit score – Even a soft check gives them an idea.

📌 Income & employment – To assess repayment ability.

📌 Debt-to-income ratio – To measure financial stability.

Example: Sarah earns $4,000/month with a credit score of 680. She pre-qualifies for:

✅ Loan Amount: $25,000

✅ Interest Rate: 5.5%

✅ Loan Term: 60 months

Now, she knows her budget before stepping into a dealership! 🚗

🔍 Why This Step Matters?

✔️ Avoid surprises at the dealership.

✔️ Compare multiple lenders to get the best rate.

✔️ Strengthen your negotiation power.

Read more about: How to Qualify for a Capital One Auto Loan

3: Advantages of Getting Pre-Qualified for a Car Loan

Some consider pre-qualification of an auto loan unnecessary. But beware, not pre-qualifying may result in higher interest rates and unfavorable loan terms. Worse of all, skipping pre-qualifying means missing one opportunity to check loan options without hurting your credit score.

🔹 Key Benefits:

✅ Pre-qualification does not impact your credit score.

✅ Helps to finalize the budget for the car purchase.

✅ Increases credibility with the dealerships.

✅ Cuts down the time spent waiting when purchasing a vehicle.

✅ Allows for better comparisons between lenders resulting in lower rates.

4: Steps to Obtain Pre-Qualification for an Auto Loan While Protecting Your Credit Score

Is pre-qualifying for an auto loan overwhelming? The process is smooth, and you can do it online quickly! Here is how to make it happen:

🔹 1. Review Your Credit Score

Most lenders prefer scores higher than 600, but some offer auto loans with bad credit. To get better rates, reduce your debt and make payments on time.

🔹 2. Collect Necessary Papers

📌 You will require identification, proof of income, employer information, and debts. If you already have these, the process will be expedited!

🔹 3. Use an Auto Loan Calculator

💡 Find out how much you are qualified for before applying! Lower monthly payments are available with sufficient down payments or lower-term loans.

🔹 4. Shop to Compare Lenders to Find the Best Deal

🏦 Best Chosen Banks: Chase, Wells Fargo

🏢 Credit Unions: They tend to have lower APRs than banks.

💻 Online Lenders: LightStream, Capital One.

Comparing lenders means it is possible to save thousands on interest!

🔹 5. Request Pre-Qualification through the Internet.

Many lenders provide preapprovals on the spot along with used car loans and auto loans with no credit check.

5: Steps to Enhance Your Chances of Pre-Qualifying for a Car Loan

Many people believe that pre-qualifying revolves around credit scores, but there are things that can improve one’s chances of qualifying and obtaining better loan offers.

✅ Pay Bills on Time – Check your report for errors, lower credit card balances and pay bills on time.

✅ Avoid Taking New Loans – Reduce small debts and improve debt to income ratio.

✅ Pay More Money in Advance – Put down at least 10-20% as this lowers loan amounts and monthly payments.

✅ Apply with a Co-Signer. If the other person has good credit, this will help you qualify for better terms.

✅ Opt for Lower Interest Rates—36-48 month terms qualify you for lower interest rates and can save you money.

6: Leading Lenders For Pre-Qualified Auto Loans In 2025

Not all lenders are the same; with the right selection, you could save thousands!

🔹 Best Banks For Auto Loans

🏦 Wells Fargo, Bank of America, Chase – Preferred customers get low rates.

🔹 Best Online Lenders For Instant Approval

💻 LightStream, Capital One Auto Navigator, AutoPay – Pre-qualifications are simple, and approvals take no time.

🔹 Best Credit Union For Low Rates

🏢 PenFed, Navy Federal, Alliant Credit Union – Offer lower APR than auto banks to averagely rated credits.

🔹 Best for Bad Credit

🛠️. Carvana, CarMax, MyAutoLoan – Even with low credit, you can still pre-qualify!

7: The Dos and Don’ts of Pre-Qualifying for a Car Loan

Never make the mistake of thinking pre-qualifying has no flaws; it can cost you higher interest rates or rejection altogether. With careful planning, you can get the best auto loan deals.

✅ Applying with Too Many Lenders at One Time 📉

Too many soft inquiries won’t hurt your credit, but hard ones can and will kill your score.

✅ Not Checking Loan Terms 💵

Focusing on the monthly payment isn’t the only thing to consider; fees, hidden charges, and high APRs can easily turn a cheap-looking loan into an expensive one.

✅ Ignoring Your Budget 💰

A big loan may seem like a wonderful option, but it can be detrimental if you don’t have the means to repay it. You should always keep your monthly payment within a reasonable and comfortable range.

✅ Skipping the Fine Print 📄

Beware of penalties for prepayments, high fees for late payments, and false “introductory” interest rates that fall later on.

8: Answers to Common Questions About Auto Loan Pre-qualifications

- Does pre-qualifying for an auto loan impact my credit score?

Not at all. Most lenders utilize a soft credit inquiry that does not affect your score.

- How long does it take to complete the pre-qualification steps?

Depending on the lender, This can take a few minutes to a day.

- Can I pre-qualify without a down payment?

You can, but be prepared to face higher interest rates and tougher approval conditions.

- What is the difference between Pre-Qualification and Pre-Approval?

Pre-Qualification is only a rough estimate, while Pre-Approval signifies that the lender has properly examined your finances.

- Can I get pre-qualified for a used car loan?

Definitely! A lot of lenders provide this service for new and pre-owned cars.

- What is the best score to have for preliminary qualification?

Scores above 660 yield the best rates, but other lenders with lower standards offer them with higher interest attached.

9: Get Pre-Qualified Now and Claim Your Dream Car!

Acquiring an auto loan is quite tasking and full of checks, which could destroy their credit standing. However, pre-qualifying for an auto loan is easy and won’t cost you a thing!

🔥 Why Should I Pre-Qualify?

Soft inquiry only, so there is no impact on your total credit score!

Helps you know your budget while shopping for the right car.

Ability to get a better rate as you compare several lenders for the loan.

Ability to negotiate with more power because dealers take pre-qualified buyers more seriously.

🚀 Take Action Today!

Check your pre-qualification now and see no impact on your credit!

Look for auto loan pre-qualification forms online and get the best options.

Obtain lower rates and drive your dream car in no time!