Found the perfect used car from a private seller? Don’t let financing stop you! A private party auto loan lets you buy that dream car directly from the owner – no dealership markups, just you, the seller, and a great deal waiting to happen.

1: Why Private Party Auto Loans Can Be Tricky (But Worth It)

Most people assume getting a car loan is easy—walk into a dealership, sign some papers, and drive off. But when you’re buying from a private seller? That’s where things get interesting. Private party auto loans don’t work like dealer financing, and if you’re not prepared, you could hit some serious roadblocks.

The good news? Once you understand how they work, private party car financing can actually save you money. Dealerships mark up prices and push unnecessary add-ons, but buying directly from an owner often means better deals. The catch? You’ve got to know where to look for loans, what lenders want, and how to avoid scams.

Why Private Party Loans Are Different (And Sometimes Harder)

Banks and credit unions see private sales as riskier than dealer purchases. Why?

- No middleman: Dealerships handle paperwork and warranties—private sellers don’t.

- Car condition: Lenders worry you’re buying a lemon (unless you get it inspected).

- Stricter rules: Some banks won’t even offer private party auto loans for older or high-mileage cars.

But here’s the kicker: If you qualify, you could snag lower interest rates than dealer financing. Credit unions are especially great for this—they often have the best private party auto loan rates for members.

Who Should Consider a Private Party Loan?

- Smart shoppers: You want to avoid dealership markups.

- Negotiators: Private sellers are often more flexible on price.

- Credit-conscious buyers: With decent credit, you can land better terms than a dealer’s “special financing.”

The Big Fear (And How to Beat It)

A lot of buyers stress: “What if I get scammed?” It’s a real concern, but avoidable:

- Never skip the inspection: A $100 pre-purchase check can save thousands.

- Verify the title: No liens, no “salvage” surprises.

- Use escrow for big deals: Sites like Escrow.com protect your cash until you get the car.

Bottom line? Private party auto loans aren’t the Wild West—they just require a little more homework. And if you do it right, you could drive away with a sweet ride and extra cash in your pocket.

2: What Exactly Is a Private Party Auto Loan? (And How It Works)

Let’s clear up the confusion: A private party auto loan isn’t some exotic financial product. It’s just a car loan for when you’re buying from a regular person instead of a dealership. But unlike dealer financing—where the lender and seller work together—you’re the middleman making it all happen.

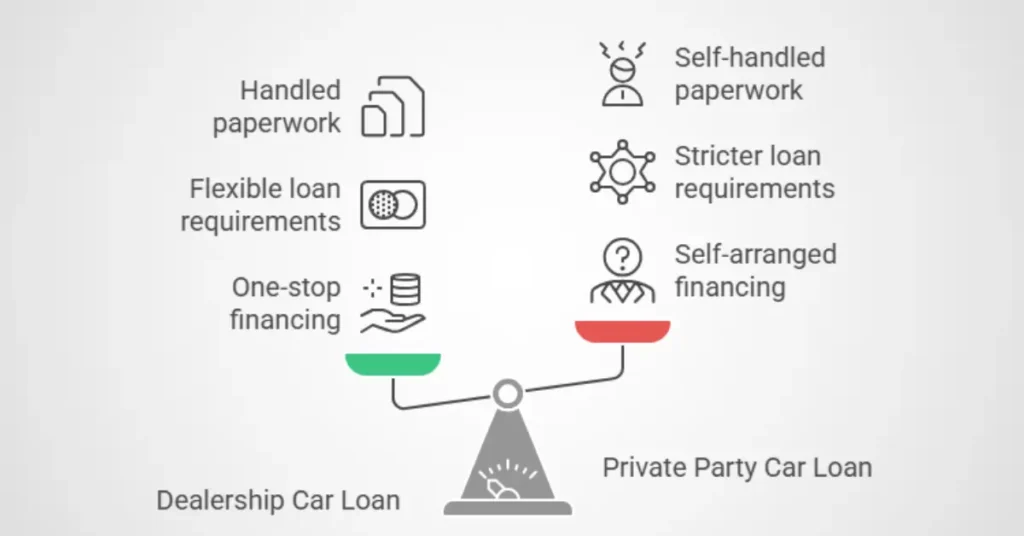

How It’s Different From Dealer Loans

- No “one-stop shop”: At a dealership, they arrange financing for you. Private sales? You hunt down the loan yourself.

- Stricter rules: Lenders may require higher credit scores or bigger down payments.

- More legwork: You’ll handle title transfers, bills of sale, and insurance—no finance desk to do it for you.

Private Party Loan vs. Personal Loan

Some buyers think: “Why not just use a personal loan?” Here’s the difference:

- Auto loans: Lower rates (since the car is collateral).

- Personal loans: Higher rates (no collateral), but you can use them for anything.

Example: A $15K auto loan might cost you 6% interest, while a personal loan could hit 12%. That’s thousands extra over five years!

Who Offers Private Party Loans?

- Banks: Big names like Chase or Bank of America, but they’re picky.

- Credit unions: Often the best rates (think 1-2% lower than banks).

- Online lenders: Fast approvals, but watch for high fees.

Real-Life Example:

Imagine you’re buying a used Toyota Camry from a private seller for $12,000. Here’s how it plays out:

- You get pre-approved for a private party auto loan at 5% from your credit union.

- The seller meets you at their bank to pay off their loan (if they have one).

- You sign the title, get the keys, and drive off—no dealer fees, no pressure.

The Golden Rule: Always get pre-approved before shopping. Nothing’s worse than finding the perfect car and realizing you can’t get a loan for it!

Read more about: Smart Tips to Get Your First Auto Loan Approved

3: Where to Get a Private Party Auto Loan (Best Lenders Revealed)

Most people assume banks are the only option for private party auto loans. That’s like thinking you can only buy groceries at one store – totally wrong! The truth is, you’ve got multiple places to score financing, and some might surprise you with better rates and terms.

Let’s break down your best options for private party car financing:

Banks: The Traditional Route

Banks like Chase, Wells Fargo, and Bank of America do offer private party auto loans, but here’s what they won’t tell you upfront:

- They’re picky about credit scores (usually 680+ minimum)

- Loan amounts often start at 5,000−10,000

- They might refuse to finance older cars (typically 8-10 years max)

Pro tip: Local community banks sometimes have more flexible private party loan requirements than the big national chains.

Credit Unions: The Hidden Gem

If banks give you the cold shoulder, credit unions could be your golden ticket. Why? Because:

- They typically offer lower interest rates (often 1-2% less than banks)

- More willing to work with members who have fair credit

- Often have special private party auto loan programs

Remember to ask about their “private purchase auto loans” – some have specific products just for this situation.

Online Lenders: Fast But Read the Fine Print

Digital lenders like LightStream or Capital One can be great for:

- Lightning-fast approvals (sometimes same-day funding)

- Competitive rates if you have good credit

But watch out for: - Higher rates if your credit isn’t stellar

- Strict vehicle requirements

- Possible prepayment penalties

Who to Avoid Like the Plague

- “Buy here, pay here” lots pretending to offer private party loans

- Lenders asking for money upfront (total scam alert!)

- Anyone who won’t give you a clear loan estimate in writing

My Personal Recommendation? Start with credit unions for private party auto loans – they consistently offer the best combo of rates and flexibility. Then check online lenders for quick comparisons. Only bother with big banks if you’ve got excellent credit and want the convenience.

4: How to Qualify (Even With Bad Credit or No Down Payment)

Here’s a myth that needs busting: “If you have bad credit, forget about getting a private party auto loan.” Nope, not true! While it’s tougher, it’s far from impossible. I’ve helped people with credit scores in the 500s get approved – you just need to know where to look and how to present your case.

Credit Score Reality Check

Most lenders want to see:

- 660+ for the best private party auto loan rates

- 580-659 for approval but with higher interest

- Below 580? You’ll need to get creative (but don’t worry, we’ll cover that)

Bad Credit Workarounds That Actually Work

- Credit Unions (Again!)

- Many have special programs for rebuilding credit

- Often more forgiving of past mistakes than banks

- Might approve you with a co-signer when others won’t

- Subprime Lenders

- Specialize in bad credit auto loans

- Expect higher rates (sometimes 15-20%)

- Watch for predatory terms (no prepayment penalties is a must)

- Save Up for a Bigger Down Payment

- Even $1,000 down can make a difference

- Shows lenders you’re serious

- Reduces the amount you need to finance

The No Down Payment Dilemma

Yes, you can find private party auto loans with no money down, but:

- Your interest rate will be higher

- You’ll need excellent credit (720+)

- The car will need to be newer (typically <5 years old)

Secret Weapon: The Right Car Choice

Lenders love financing:

- Reliable makes (Toyota, Honda, etc.)

- Lower mileage (<100,000 miles)

- Newer models (<7 years old)

Pick a car that checks these boxes, and you’ll have an easier time getting approved.

Final Pro Tip: Before applying, get your free credit report at AnnualCreditReport.com. Bonus tip: Dispute any errors (they’re shockingly common!) – even a small score bump could save you thousands in interest on your private party auto loan.

5: Step-by-Step: How to Apply for a Private Party Auto Loan

Think getting a private party auto loan means endless paperwork and headaches? Think again. The process is actually pretty straightforward when you know the right steps. I’ve helped dozens of buyers navigate this, and I’m going to walk you through exactly what to do – no financial jargon, just clear action steps.

Step 1: Get Pre-Approved (Your Shopping Superpower)

Before you even look at cars, get pre-approved. Why?

- You’ll know exactly how much you can spend

- Sellers take you seriously (cash talks)

- You avoid falling in love with a car you can’t afford

How to do it:

- Check your credit score (free on Credit Karma)

- Apply with 2-3 lenders (credit unions + online lenders)

- Compare offers – look at rates AND loan terms

Step 2: Find Your Car (The Smart Way)

Now the fun part! But remember:

- Stick to your pre-approved amount

- Get the VIN for your lender

- Private party auto loans won’t cover:

- Salvage titles

- Cars over 10-12 years old (usually)

- Vehicles with 150,000+ miles

Step 3: The Must-Do Inspection

Never skip this! For about $100:

- A mechanic checks for hidden problems

- You get bargaining power if issues are found

- Lenders often require it anyway

Step 4: Paperwork Party (The Easy Checklist)

You’ll need:

- Bill of sale (seller provides)

- Title (clean, no liens)

- Proof of insurance

- Your ID and loan documents

- Odometer disclosure statement

Step 5: Closing the Deal

Here’s how it goes down:

- Meet at the seller’s bank (if they have a loan)

- Your lender sends payment directly

- Seller signs title over to you

- You get keys and drive away happy!

Pro Tip: Some lenders offer to handle the DMV paperwork for you – ask about this service!

6: Private Party Loan Pitfalls (Don’t Get Stuck!)

Everyone talks about how great private party deals are, but nobody warns you about the potential disasters. I’ve seen buyers lose thousands by making simple mistakes. Let me show you the red flags so you don’t become another horror story.

Title Trouble (The #1 Nightmare)

Watch out for:

- Salvage titles (most lenders won’t touch these)

- “Branded” titles (flood, rebuilt, lemon law)

- Liens (money still owed on the car)

Always get a title report before buying!

Sketchy Seller Signs

Run if the seller:

- Won’t let you test drive

- Can’t show maintenance records

- Pressures you to pay cash only

- Has a sob story about why they’re selling

Hidden Costs That Add Up

Budget for:

- Sales tax (varies by state)

- Registration fees

- Immediate repairs (even good used cars need stuff)

- Higher insurance costs (full coverage required)

The Interest Rate Trap

Some lenders prey on private party buyers with:

- Variable rates that balloon later

- Prepayment penalties

- Mandatory expensive warranties

Always get the full loan terms in writing before signing.

My Best Advice?

- Never rush into a deal

- Walk away if anything feels off

- Get everything in writing

- Trust your gut – if it seems too good to be true, it probably is

Remember: A great private party deal should feel fair to both sides. Take your time, do the checks, and you’ll drive away with both a great car and peace of mind.

7: FAQs – Quick Answers to Your Biggest Worries

You’d think after covering all the basics, private party auto loans would be simple. But here’s what most guides miss – the real questions that keep buyers up at night. The “what ifs” and “but hows” that can derail your purchase if you don’t have answers. Let’s tackle these head-on.

“Can I use a personal loan instead of an auto loan?”

Technically yes, but here’s why it’s usually a bad idea:

- Personal loans have higher interest rates (often 5-10% more)

- No collateral means stricter credit requirements

- Shorter repayment terms = bigger monthly payments

Exception: If you have excellent credit and can get rates close to auto loans, it might work.

“What if the seller still owes money on the car?”

This gets tricky but is solvable:

- Meet at THEIR lender’s branch

- Your loan pays off their balance first

- Get a signed lien release before handing over any money

Warning: Never take over payments directly – that’s a recipe for disaster.

“How long does approval take for private party loans?”

It varies:

- Online lenders: As fast as same-day

- Credit unions: 1-3 business days typically

- Big banks: Can drag out to a week

Pro tip: Get pre-approved before car shopping to skip the wait.

“What’s the max amount I can borrow?”

Most lenders cap at:

- 100-125% of the car’s value (for newer models)

- 80-90% for older/high-mileage vehicles

- Typically $50k maximum for private party deals

“Can I refinance a private party auto loan later?”

Absolutely! In fact, it’s smart to:

- Refinance if rates drop significantly

- Lower payments by extending the term (if needed)

- Remove a co-signer once your credit improves

Wait at least 6-12 months and make all payments on time first.

8: Final Tips to Score the Best Deal

Here’s the truth nobody tells you: Getting the loan is only half the battle. The real art is in structuring the whole deal to work in your favor. After helping hundreds of buyers, these are my insider strategies that make all the difference.

Negotiation Secrets Private Sellers Hate

- Always negotiate based on comparable listings (bring printouts)

- Point out needed repairs found during inspection

- Offer to close quickly – sellers love fast deals

- If paying cash (from your loan), use it as leverage

When to Walk Away Immediately

Red flags that should send you running:

- Seller refuses a pre-purchase inspection

- Title has “and/or” between owner names

- No service records available

- The price is suspiciously low

3 Must-Do Steps Before Signing

- Verify the VIN matches all documents

- Do a final test drive (listen for new noises)

- Confirm insurance coverage starts immediately

Your Action Plan Right Now

- Check rates with at least one credit union

- Get your credit report and fix any errors

- Start saving for a down payment (even $500 helps)

- Make a list of 3-5 target vehicles in your range

Remember: The best private party deal isn’t just about the loan – it’s about the complete package. Take your time, follow these steps, and you’ll not only get approved but drive away with genuine savings. Now go find that perfect car!