Business entrepreneurs need funds to establish and expand their businesses, and sometimes they need that funding right now. Some business owners will take out same-day business loans to bridge a cash flow shortfall or capitalize on a short-lived opportunity. Let’s take a closer look at the many types of same-day loans, what they require, and how to obtain one.

Introduction – The Truth About Same Day Business Loans

“Business loans always take weeks to get approved – there’s no way to get funding fast.”

If you believe this, you’re not alone. But here’s the reality check: Same day business loans are real, and they’re helping thousands of businesses like yours survive cash flow emergencies, grab unexpected opportunities, and keep operations running smoothly – all without the endless paperwork and waiting games of traditional bank loans.

I’ve seen firsthand how these fast funding options can be complete game-changers. Whether you’re a small business owner facing a sudden equipment breakdown, a startup needing quick capital to seize a limited-time opportunity, or an established company dealing with unexpected expenses, same-day funding can be your financial lifeline.

In this guide, I’ll walk you through everything you need to know about securing business cash fast. We’ll cover:

- Exactly how same day business loans work (and when to use them)

- The different types available to you right now

- How to qualify even with less-than-perfect credit

- Where to find the best deals with the fastest funding

Who Actually Needs Same Day Business Loans? (Hint: It Might Be You)

“Only desperate businesses or poor money managers need emergency funding.”

Let’s bust this myth right now. I’ve worked with hundreds of business owners who needed fast cash, and guess what? Most were smart operators facing completely normal business challenges. The truth is, even well-run businesses hit unexpected snags that require quick financing.

Here’s who really benefits from same day business loans:

1. The Sudden Opportunity Grabber

You land a huge wholesale order that could double your monthly revenue – but need cash upfront to fulfill it. Traditional loan? Too slow. Same day funding? Game changer.

2. The Emergency Fixer

That industrial oven generating your daily revenue just died. Every day it’s down costs you thousands. Fast business loans get you back operating before you lose customers.

3. The Seasonal Business Warrior

If you’re in retail, tourism, or agriculture, you know the struggle – needing to stock up fast before peak season hits. Quick business funding bridges that gap perfectly.

4. The Credit-Challenged Hustler

Maybe your personal credit took some hits, or your business is too new for traditional loans. Many same day lenders focus more on your cash flow than your credit score.

5. The Growth Spurt Survivor

Congratulations – business is booming! But now you need to hire staff, buy more inventory, and expand operations… yesterday. Fast capital keeps that momentum going.

Read more about: Pro Tips to Slash Your Business Loan Costs

Your 5 Best Same Day Business Loan Options (With Real Pros & Cons)

“All fast business loans are basically the same – just pick the first one you find.”

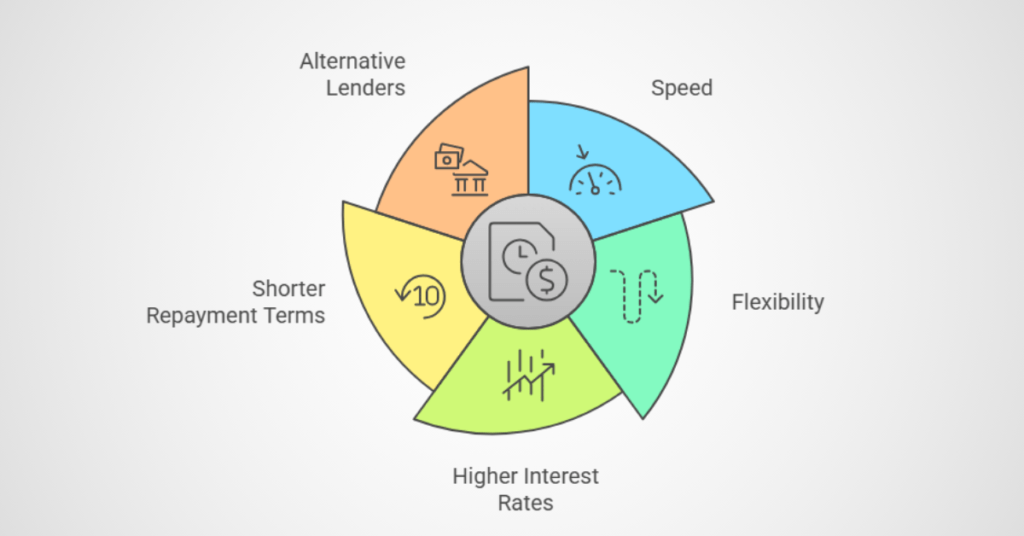

Wrong approach. I’ve seen business owners lose thousands by not understanding their options. Let me break down the 5 main types of same day business loans, so you can choose wisely:

1. Online Term Loans (The Speedy Standard)

- What it is: Lump sum paid back over 3-24 months

- Best for: Established businesses needing predictable payments

- Speed: Funds in 1-2 business days (some same day)

- Watch out for: Potentially high APRs

2. Merchant Cash Advances (The Credit Card Heavyweight)

- What it is: Advance based on future credit card sales

- Best for: Retailers/restaurants with strong card revenue

- Speed: Often same day funding

- Watch out for: Daily repayments can strain cash flow

3. Business Lines of Credit (The Flexible Friend)

- What it is: Reusable credit up to your limit

- Best for: Ongoing or unpredictable needs

- Speed: 1-3 days after initial approval

- Watch out for: Potential maintenance fees

4. Invoice Financing (The B2B Problem Solver)

- What it is: Cash advance on unpaid invoices

- Best for: Businesses with reliable clients but slow payers

- Speed: Often within 24 hours

- Watch out for: Fees can add up quickly

5. Microloans (The Startup Savior)

- What it is: Small loans (5k−50k) from alternative lenders

- Best for: New businesses or smaller cash needs

- Speed: Some lenders offer same day approval

- Watch out for: Lower maximum amounts

The Truth About Qualifying for Same Day Business Loans

“You need perfect credit and years in business to get fast funding.”

Nope—not true at all. I’ve helped business owners with credit scores in the 500s and startups less than 6 months old secure same-day loans. The secret? Knowing what lenders actually care about.

Here’s the real checklist for getting approved fast:

1. Minimum Credit Score? (It’s Lower Than You Think)

- Some online lenders accept scores as low as 500

- Others focus more on business revenue than personal credit

- Pro Tip: Even if your credit isn’t great, showing strong cash flow can help

2. How Much Revenue Do You Need?

- Many lenders require 5K−10K+ monthly revenue

- Startups? Look for lenders specializing in new businesses

- Watch Out: Super-new businesses (under 3 months) may need a personal guarantee

3. Documents Required (Way Less Than a Bank)

- Basic stuff: Bank statements (3-6 months), business tax ID, proof of ownership

- No piles of paperwork: Most applications take under 30 minutes

- Bonus: Some lenders don’t even ask for a business plan

4. Collateral? (Not Always Needed)

- Unsecured loans exist (no assets required)

- Personal guarantees are common for bad credit borrowers

- Best for no-collateral loans: Merchant cash advances & invoice financing

5. How to Boost Approval Odds

- Fix small errors on your credit report before applying

- Show consistent deposits in your business bank account

- Apply early in the day—some lenders process faster before 2 PM

Where to Actually Get Same Day Business Loans (Trusted Lenders)

“All fast business loan lenders are basically the same – just pick the first one Google shows you.”

Stop right there! This is how business owners get stuck with terrible terms. After helping hundreds of clients secure funding, I’ve learned that not all same-day lenders are created equal. Some will bleed you dry with hidden fees, while others can be genuine lifesavers.

Here’s my curated list of lender types that actually deliver fast cash without the nightmares:

1. The Speed Demons (Fund in Under 24 Hours)

- Best for: True emergencies when you need cash today

- Top picks: OnDeck, Kabbage, BlueVine

- What makes them special: Automated approvals, same-day funding available

- Watch for: Higher APRs (30-70% range)

2. The Bad Credit Heroes

- Best for: Scores below 600

- Top picks: Fundbox, Fora Financial

- Secret sauce: They weigh bank activity heavier than credit scores

- Bonus: Fundbox reports to business credit bureaus

3. The No-Collateral Champs

- Best for: Businesses without assets to pledge

- Top performers: PayPal Working Capital, Square Loans

- Why they’re different: Uses your sales history instead of collateral

- Cool feature: Payments adjust with your sales volume

4. The Startup Specialists

- Best for: Businesses under 1 year old

- Go-to options: Lendio, Accion

- What stands out: Will work with minimal business history

- Pro tip: Have at least 3 months of banking history ready

Plan B – Alternatives When You Don’t Qualify

“If you can’t get a same day business loan, you’re out of options.”

Not even close! I’ve helped clients find creative solutions when traditional fast loans didn’t work out. Here’s your emergency toolkit:

1. Business Credit Cards (The Underrated Hero)

- Good for: Smaller amounts (1k−50k)

- Speed: Instant approval options available

- Pro move: Look for 0% intro APR cards

- Watch out: Personal credit usually required

2. Crowdfunding (The Community Lifeline)

- Best for: Product-based businesses

- Fastest platforms: Kickstarter, Indiegogo

- Secret weapon: Pre-sell your product to fund production

- Success tip: Have a compelling story and rewards

3. Purchase Order Financing

- Perfect when: You have confirmed orders but no cash to fulfill

- How it works: Lender pays your supplier directly

- Hidden gem: Doesn’t show up as debt on your books

4. Peer-to-Peer Lending

- Great for: Those who just miss traditional requirements

- Top platforms: LendingClub, Funding Circle

- Bonus: Often more flexible than banks

- Timeline: Can be 3-5 days (not same-day but fast)

5. Vendor Negotiation (The Forgotten Option)

- Try this first: Ask suppliers for extended terms

- Magic phrase: “Can we do net-60 instead of net-30?”

- Success rate: Higher than you’d think – especially if you’re a good customer

Your Burning Same Day Business Loan Questions – Answered

“All the important details are hidden in fine print – you won’t know the truth until it’s too late.”

Not on my watch! After helping hundreds of business owners navigate fast funding, I’m pulling back the curtain on what you really need to know. These are the actual questions my clients ask most – with the straight answers lenders don’t always provide upfront.

Q1: Can I really get same day funding with bad credit?

The real deal: Yes, but with caveats. Many online lenders focus more on your business bank activity than your personal score. I’ve seen approvals with scores as low as 500, but expect:

- Higher interest rates (sometimes 50%+ APR)

- Possibly daily or weekly repayments

- Lower maximum loan amounts

Q2: What’s the fastest funding option available?

Hands down: Merchant cash advances. I’ve seen funds hit accounts in as little as 4 hours. But beware – these come with:

- The highest factor rates (often equivalent to 70-100% APR)

- Daily repayment from your credit card sales

- Potentially aggressive collection practices

Q3: Are there any hidden fees I should watch for?

The sneaky ones to ask about:

- Origination fees (1-5% of loan amount)

- Prepayment penalties (yes, some charge for paying early!)

- ACH transfer fees (10−50 per transaction)

- Late payment fees (can be brutal)

Q4: How much can I actually borrow same day?

Typical ranges:

- First-time borrowers: 2,000−50,000

- Established businesses: Up to $250,000

- Merchant cash advances: Based on monthly credit card sales

Q5: Will applying hurt my credit score?

The truth: Most do a soft pull initially (no impact), but hard pull if you proceed. Exceptions:

- PayPal Working Capital: No credit check

- Square Loans: Soft pull only

- Some invoice financing: Business credit only

The Final Verdict – Are Same Day Loans Right For You?

“Fast business loans are always either a miracle or a scam – no in-between.”

Let’s get real – like any financial tool, same day business loans can be brilliant or brutal depending on how you use them. After helping countless business owners navigate these waters, here’s my honest take:

When They’re Worth Every Penny

✅ Real emergencies (equipment failure, critical inventory)

✅ Can’t-miss opportunities (limited-time deals, bulk discounts)

✅ Short-term gaps (waiting on slow-paying invoices)

✅ You have repayment certainty (contract payment coming)

When to Walk Away

❌ Long-term financing needs (the rates will kill you)

❌ Uncertain repayment ability (don’t gamble with daily payments)

❌ Just for convenience (if it’s not urgent, find cheaper money)

My Best Advice

- Shop at least 3 lenders – rates vary wildly

- Run the numbers twice – calculate total repayment, not just payments

- Have an exit plan – know exactly how you’ll repay

- Read every word – especially about prepayment and late fees