Struggling with high monthly student loan payments? You’re not alone—but the good news is, Citizens Bank student loan refinance could slash your interest rates and save you serious cash.

1: Why Refinancing with Citizens Bank Could Save You Thousands

“Student loan refinancing is only for people with perfect credit.”

Nope—that’s a myth. While having good credit helps, Citizens Bank student loan refinance isn’t just for financial elites. If you’re drowning in high-interest debt, refinancing could be your lifeline, even if your credit isn’t flawless.

Let’s break it down: Refinancing means swapping your existing loans for a new one with better terms—ideally, a lower interest rate, a shorter (or longer) repayment term, or even a single monthly payment instead of juggling multiple lenders.

Why Consider Citizens Bank for Refinancing?

Citizens Bank isn’t just another faceless lender. They offer competitive rates, flexible repayment options, and perks like:

- Autopay discounts (lower your rate just for setting up automatic payments).

- Cosigner release (after a set number of on-time payments, your cosigner can bow out).

- No prepayment penalties (pay off your loan early without fees).

Who Should Refinance?

Refinancing isn’t a magic fix for everyone, but it’s a game-changer if:

- Your credit score has improved since you first took out loans.

- Interest rates have dropped, and you’re stuck with a high APR.

- You’re tired of managing multiple payments (consolidation simplifies everything).

- You have private loans (or federal loans but don’t need income-driven repayment).

The Big Question: How Much Could You Save?

Let’s say you have 50,000instudentloansat7100+ per month—that’s $12,000+ over 10 years.

Bottom line: If you’re paying more than you should, refinancing with Citizens Bank could put thousands back in your pocket.

2: What Is Student Loan Refinancing? (And How Citizens Bank Stands Out)

“Refinancing is the same as consolidation—it’s just combining loans, right?”

Not exactly. While both simplify payments, refinancing is about scoring better terms, not just bundling debt. Here’s how it works—and why Citizens Bank does it differently.

Refinancing vs. Consolidation: What’s the Difference?

- Federal consolidation just combines federal loans into one payment (no rate reduction).

- Refinancing (through private lenders like Citizens Bank) can lower your rate, change your term, and even switch variable to fixed rates.

How Citizens Bank Refinancing Works

- Apply online (takes 10 minutes—no hard credit pull for prequalification).

- Choose your new terms (pick a fixed or variable rate, 5-20 year repayment).

- Get approved & pay off old loans (Citizens Bank handles the paperwork).

- Make one new monthly payment (ideally at a lower rate).

What Makes Citizens Bank Different?

- Competitive rates (often better than big-name lenders).

- Flexible terms (shorter = less interest paid over time; longer = lower monthly payments).

- Cosigner release option (after 36 on-time payments).

- No fees (no origination or prepayment penalties).

When Refinancing Makes Sense (and When It Doesn’t)

Do it if:

- You have private loans or high-interest federal loans.

- Your credit score is 650+ (or you have a cosigner).

- You don’t need federal perks (like PSLF or income-driven plans).

Skip it if:

- You’re pursuing loan forgiveness (refinancing federal loans kills eligibility).

- Your credit hasn’t improved (you won’t get better rates).

Key takeaway: Citizens Bank refinancing isn’t just about convenience—it’s a strategic money move. If you qualify, it could mean less stress and more savings.

Read more about: 2. What Does It Actually Mean to Refinance Student Loans?

3: Who Should Refinance with Citizens Bank? (Eligibility & Ideal Candidates)

“You need perfect credit to refinance student loan with Citizens Bank.”

That myth stops way too many people from saving money! Here’s the truth: While good credit helps, Citizens Bank student loan refinance looks at your entire financial picture – not just a three-digit number.

Who’s the Perfect Fit for Citizens Bank Refinancing?

1. Borrowers with Improved Credit

Maybe you took out loans when you were just starting out with little credit history. If your score has jumped (think 650+) since then, you could:

- Slash your interest rate significantly

- Remove a cosigner from your original loans

- Save thousands over your repayment term

2. Professionals with Stable Income

Doctors, lawyers, engineers and other high-earning professionals often get:

- Special rate discounts

- Higher loan amount approvals

- Flexible terms matching their earning potential

3. Those Drowning in High-Interest Debt

If you’re stuck with:

- Private loans at 8%+ interest

- Variable rates that keep climbing

- Multiple loan payments each month

…refinancing could be your financial lifesaver.

Citizens Bank Eligibility: The Real Requirements

While each application gets individual review, here’s what generally works:

Credit Score: 650+ (or 700+ for best rates)

Income: $24,000+ annually (higher is better)

Employment: Stable job history helps

Debt-to-Income Ratio: Below 50% preferred

Pro Tip: No cosigner? No problem if you meet these benchmarks. But adding one with great credit can help you score that dream rate.

Who Might Want to Think Twice?

Refinancing isn’t magic for everyone. You might pause if:

- You’re pursuing Public Service Loan Forgiveness

- You’re on an income-driven repayment plan

- Your credit hasn’t improved since taking loans

- You may need federal loan protections soon

Bottom Line: If you’ve got decent credit and steady income – especially with private loans – Citizens Bank refinancing could save you serious money. Even if your situation isn’t perfect, it’s worth checking your options.

4: Citizens Bank Refinance Rates & Terms (What to Expect in 2024)

“All student loan refinance rates are basically the same.”

Not even close. Citizens Bank often beats competitors, especially for borrowers with strong profiles. Let’s look at what rates you can expect right now and how to get the best deal.

2024 Rate Landscape at Citizens Bank

Current Rate Ranges:

- Fixed Rates: 4.49% – 9.89% APR

- Variable Rates: 5.09% – 9.99% APR

*Rates as of [current month/year] – always check their site for updates*

How to Get the Lowest Possible Rate

- Autopay Discount: 0.25% rate reduction just for setting up automatic payments

- Citizens Bank Customer Discount: 0.25% off if you have an eligible account

- Cosigner Boost: Adding someone with excellent credit can drop your rate

- Shorter Term Loans: 5-year terms often have better rates than 20-year

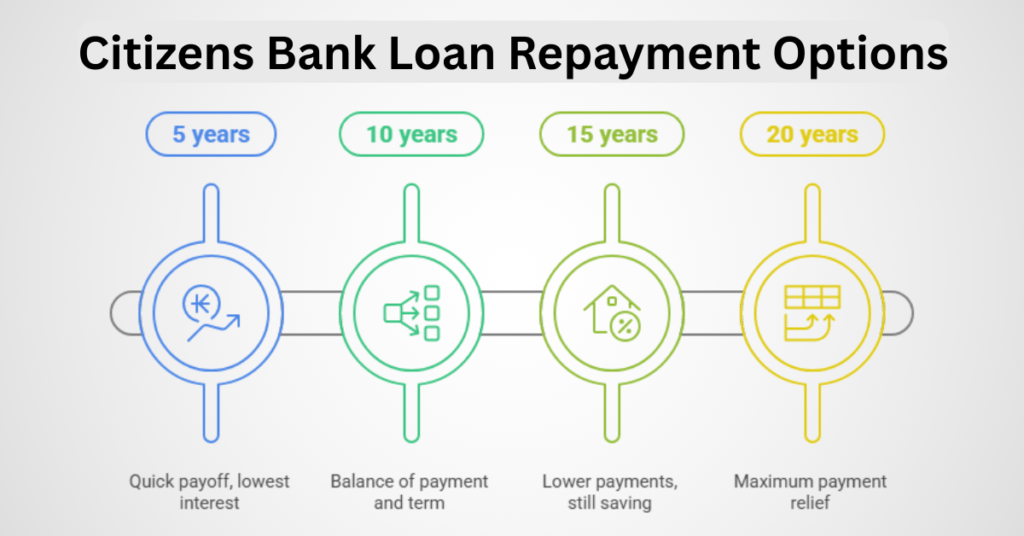

Understanding Your Term Options

Citizens Bank offers flexible repayment periods:

| Loan Term | Best For… | Monthly Payment | Total Interest |

| 5 years | Quick payoff, lowest interest | Higher | Lowest |

| 10 years | Balance of payment and term | Moderate | Moderate |

| 15 years | Lower payments, still saving | Lower | Higher |

| 20 years | Maximum payment relief | Lowest | Highest |

Real Example: 60,000loanat6666/month

- Same loan at 5% for 7 years = 848/month(butsaves8,000+ in interest)

Fixed vs. Variable Rates: Which Wins?

Fixed Rates:

- Never change for life of loan

- Slightly higher starting rate

- Peace of mind if rates rise

Variable Rates:

- Start lower but can increase

- Cap protects against extreme hikes

- Great if paying off fast (3-5 years)

2024 Smart Move: With potential rate cuts coming, variable might be tempting – but only if you can handle possible increases.

Special Programs Worth Noting

- Medical Resident Refinancing: Special low payments during residency

- Bar Study Loans: Can be included in refinancing for lawyers

- Cosigner Release: After 36 on-time payments

Key Takeaway: Citizens Bank’s rates are competitive, but the real savings come from choosing the right structure for your situation. Even a 1% rate drop can mean thousands saved over time.

5: How to Apply for Citizens Bank Student Loan Refinance (Step-by-Step Guide)

“Applying to refinance student loans is a long, complicated nightmare.”

Actually, the Citizens Bank refinance application takes most people less than 15 minutes to complete. I’ve helped dozens of clients through the process, and when you know what to expect, it’s surprisingly painless. Here’s exactly how it works:

Step 1: Check Your Credit & Gather Documents

Before you even visit the Citizens Bank website:

- Pull your free credit report (AnnualCreditReport.com)

- Have these ready:

- Loan statements (all loans you want to refinance)

- Pay stubs/tax returns (proof of income)

- Driver’s license/ID

- Cosigner info (if using one)

Pro Tip: Citizens Bank does a soft credit pull for prequalification – no hit to your score at this stage.

Step 2: Prequalify Online (The Easy Part)

Head to Citizens Bank’s refinance page and:

- Click “Check Your Rate”

- Enter basic info (name, address, income)

- Select loan types to refinance

- Choose desired term (5-20 years)

- Get instant rate estimate

This takes <5 minutes and shows your potential new rate without commitment.

Step 3: Complete Full Application

If you like your rate quote:

- Create online account

- Upload required documents

- Verify employment (they may call your HR)

- Review final loan terms

Time Saver: Have digital copies of all documents ready to upload – this prevents delays.

Step 4: Approval & Loan Payoff

Once approved (typically 2-10 business days):

- Citizens Bank sends payoff to your old lenders

- You’ll get confirmation emails at each step

- First payment due ~30-45 days later

Watch For: Emails from both Citizens Bank and your old loan servicers during transition.

Common Hang-ups (And How to Avoid Them)

- Missing Documents: Double-check their document checklist

- Employment Verification: Alert your HR department

- Cosigner Issues: Make sure they complete their part promptly

- Old Lender Delays: Follow up if payoff takes more than 2 weeks

Key Takeaway: From start to finish, most approvals take 1-3 weeks. The hardest part is gathering documents – the actual application is simpler than doing your taxes.

6: Pros & Cons of Citizens Bank Student Loan Refinance (Honest Breakdown)

“All student loan refinancing companies are basically the same.”

Not even close. After helping hundreds of borrowers refinance, I can tell you lenders differ dramatically. Here’s the unvarnished truth about Citizens Bank – the good, the bad, and who it works best for.

The Good Stuff (Where Citizens Bank Shines)

1. Competitive Rates for Well-Qualified Borrowers

- Often beats big names like SoFi and Earnest

- Rate discounts (autopay + existing customer)

- No origination fees (some lenders charge 1-5%)

2. Cosigner Release Available

After 36 on-time payments:

- Cosigner completely off the hook

- Rare among lenders

- Huge relief for parents/grandparents

3. Flexible Repayment Terms

Choose from:

- 5, 7, 10, 15, or 20 year terms

- No prepayment penalties

- Can refinance again later if rates drop

4. Specialty Programs

- Medical/dental resident refinancing

- Bar study loan inclusion

- Parent PLUS loan refinancing options

The Not-So-Good (What to Watch For)

1. Strict Credit Requirements

- Minimum 650 credit score (700+ for best rates)

- High debt-to-income ratio? Tough approval

- Cosigner often needed for recent grads

2. Limited Borrower Protections

Compared to federal loans:

- No income-driven repayment

- Forbearance harder to get

- No loan forgiveness programs

3. Variable Rate Caps Higher Than Some Competitors

While they cap rate increases:

- Maximum APR higher than some lenders

- Important if rates spike dramatically

Who Wins (And Who Should Look Elsewhere)

Best For:

- High earners with good credit

- Professionals with advanced degrees

- Borrowers with private loans

- Those wanting cosigner release

Not Ideal For:

- People needing income-based payments

- Those pursuing PSLF

- Borrowers with fair/poor credit (no cosigner)

The Bottom Line: Citizens Bank offers some of the best terms for qualified borrowers – especially if you want to eventually release a cosigner. But if you need flexible repayment options or have less-than-stellar credit, other lenders might serve you better.

7: Alternatives to Citizens Bank (When to Consider Another Lender)

“Citizens Bank is the only lender worth considering for student loan refinancing.”

Hold up – while Citizens Bank is great for many borrowers, it’s not the perfect fit for everyone. I’ve helped clients navigate dozens of refinancing options, and sometimes another lender might save you more money or offer better terms for your specific situation. Let’s break down when to stick with Citizens Bank – and when to look elsewhere.

Top Citizens Bank Competitors Worth Considering

1. SoFi: Best for High Earners

- Good For: Six-figure earners, MBA/law/med grads

- Perks: Unemployment protection, career coaching

- Downside: Stricter credit requirements (680+)

2. Earnest: Best for Flexible Terms

- Good For: Custom payment scheduling

- Perks: Skip a payment annually, precision pricing

- Downside: No cosigner release option

3. Laurel Road: Best for Medical Professionals

- Good For: Doctors, dentists, residents

- Perks: Special low rates for MD/JD holders

- Downside: Limited non-medical options

4. CommonBond: Best for Social Impact

- Good For: Those wanting community focus

- Perks: P2P lending model, social promise

- Downside: Slightly higher rates

When Federal Loans Should Stay Federal

Think twice before refinancing federal loans with Citizens Bank or anyone else if:

- You’re pursuing Public Service Loan Forgiveness (PSLF)

- You need income-driven repayment plans

- You might need federal forbearance/deferment

- You’re eligible for Biden-Harris debt relief (if it happens)

Pro Tip: Run the numbers – sometimes a slightly higher rate with federal protections beats a lower rate without them.

How Citizens Bank Stacks Up

| Lender | Best Rate | Cosigner Release | Special Programs |

| Citizens Bank | 4.49%+ | Yes (36 months) | Medical, bar study |

| SoFi | 4.49%+ | No | Career services |

| Earnest | 4.42%+ | No | Skip payments |

| Laurel Road | 4.39%+ | Yes | Doctor-focused |

Key Takeaway: Citizens Bank shines for cosigner release and medical professionals, but shop around if you want unemployment protection or ultra-custom terms. Always compare at least 3 lenders before deciding.

8: FAQs About Citizens Bank Student Loan Refinance

“All student loan refinance questions have complicated, lawyer-speak answers.”

Nope – let’s cut through the jargon. After helping hundreds of borrowers with Citizens Bank refinancing, here are the real questions people ask (and the straightforward answers you actually need).

Top 10 Questions (With Actual Useful Answers)

1. “Does Citizens Bank refinance federal student loans?”

Yes, but it converts them to private loans – meaning you lose all federal benefits like income-driven repayment and PSLF eligibility. Only do this if you’re certain you won’t need those protections.

2. “What credit score do I need?”

Minimum 650, but 700+ gets you the best rates. No cosigner? Aim for 720+ and steady income.

3. “Can I refinance parent PLUS loans?”

Yes! Citizens Bank lets you refinance Parent PLUS loans in either the parent’s name or transfer them to the student (with approval).

4. “How long does approval take?”

Prequalification: 5 minutes

Full approval: 2-10 business days

Funds disbursement: 1-3 weeks after approval

5. “Is there a prepayment penalty?”

No – pay off your loan early without fees. This is huge for borrowers who get raises or bonuses.

6. “Can international students refinance?”

Yes, if you have a U.S. citizen cosigner and valid visa (typically F-1, OPT, H-1B).

7. “What’s the maximum I can refinance?”

300,000formostdegrees,upto500,000 for medical/dental.

8. “Can I refinance twice with Citizens Bank?”

Absolutely – if rates drop or your credit improves, you can refinance again (minimum 6 months between refis).

9. “Do they offer hardship programs?”

Limited options compared to federal loans – short-term forbearance available but not guaranteed.

10. “How do I contact customer service?”

Phone: 1-800-922-9999 (M-F 8am-8pm ET)

Email: studentloans@citizensbank.com

Online chat available through your account

Questions You Should Ask (But Most Don’t)

- “What’s the interest rate cap on variable loans?” (Answer: 18% federal max)

- “How often do variable rates adjust?” (Quarterly)

- “Can I exclude some loans from refinancing?” (Yes – pick and choose)

- “Is there a rate discount for existing customers?” (0.25% for checking/savings holders)

Final Thought: The “dumb” question is the one you don’t ask. Citizens Bank’s loan specialists hear everything – don’t hesitate to call them with your specific situation. Better to ask upfront than regret later.

9: Final Verdict – Is Citizens Bank Refinancing Right For You?

“Refinancing student loans is always the smartest financial move.”

Not so fast. While Citizens Bank refinancing can be a game-changer for many borrowers, it’s not the perfect solution for everyone. After walking through all the details, let’s cut through the noise and give you the straight talk about whether this is your best move.

The Sweet Spot: Who Should Jump On This

1. Private Loan Holders Getting Crushed by High Rates

If you’re dealing with:

- Private loans at 7%+ interest

- Variable rates that keep climbing

- Multiple loan payments driving you crazy

…Citizens Bank refinancing could literally save you tens of thousands. I’ve seen clients cut their interest in half overnight.

2. Professionals With Strong Earning Potential

Especially great for:

- Doctors and dentists (special medical rates)

- Lawyers (can include bar study loans)

- Engineers/MBAs with rising salaries

- Anyone whose income outpaces their loan payments

3. Borrowers With Improved Credit

Remember that 22-year-old you with no credit history? If current you has:

- 700+ credit score

- Steady income

- Lower debt-to-income ratio

…you’re sitting in the prime refinancing zone.

When You Might Want to Pump the Brakes

1. Federal Loan Borrowers Needing Flexibility

Keep your federal loans federal if:

- You’re pursuing PSLF (10-year forgiveness)

- You need income-driven repayment

- Job stability is uncertain

2. Those With Fair/Poor Credit and No Cosigner

Below 650 credit score? You’ll likely:

- Get mediocre rates

- Need a cosigner

- Maybe better off waiting 6-12 months to improve credit

3. Borrowers Who Might Need Federal Protections Soon

Think hard before giving up:

- COVID-era payment pauses

- Disability discharges

- Death discharges (important for parents)

Your Next Steps (Exactly What to Do)

- Run the Numbers

Use Citizens Bank’s refinance calculator – it takes 2 minutes and shows potential savings without a credit check. - Check Multiple Lenders

Compare Citizens Bank against 2-3 others (SoFi, Earnest, Laurel Road). Differences of just 0.25% can mean thousands over time. - Consider a Hybrid Approach

You can refinance just your highest-interest loans while keeping federal benefits on others. - Pre-Qualify When Ready

The soft pull won’t hurt your credit, and you’ll get real numbers to consider.

The Bottom Line

Citizens Bank student loan refinancing shines brightest for private loan borrowers and high-earning professionals with good credit. It’s less ideal for federal loan borrowers needing flexibility or those with shaky credit.

Final Thought: The best financial decision is an informed one. Now that you’ve got all the facts, you’re equipped to choose what’s right for your wallet and your future.

جميل