1. Introduction:

Start with a relatable question: Have you ever considered purchasing a car but do not possess sufficient cash to cover the costs? In this article, we explain the purpose of auto loans. An auto loan is a loan issued for purchasing a car. Rather than paying the total amount immediately, you can take a loan from a bank, credit union, or dealership and pay it back with interest.

Here’s how it works:

- You gain access to the car immediately.

- You pay equal monthly installments over a specified time frame (36, 48, or 60 months).

- An interest fee that acts as a profit to the lender for providing the loan is charged.

- Legally, the lender owns the car until you finish making the payments.

🔍 Auto loans vs. Other loans – What Are The Differences?

An auto loan is a secured loan. This indicates that, in this scenario, the car is collateral (or asset) for the loan taken. In case of default, the lender can retrieve the vehicle.

This contrasts with a personal loan (which is not secured) or a pension (which is for a home). Auto loans are much easier to acquire than personal loans because the lender has the vehicle as protection.

🛑 Do You Need An auto loan?

Getting a car on loan might not be ideal for everyone. It’s fantastic if you can simply pay in cash. However, for many people, an auto loan allows them to own a dependable vehicle without draining their savings.

✅ However, it’s a good approach if you need reliable transportation but lack the requisite funds.

🚫 But taking a loan with unforgiving high interest rates is a terrible idea.

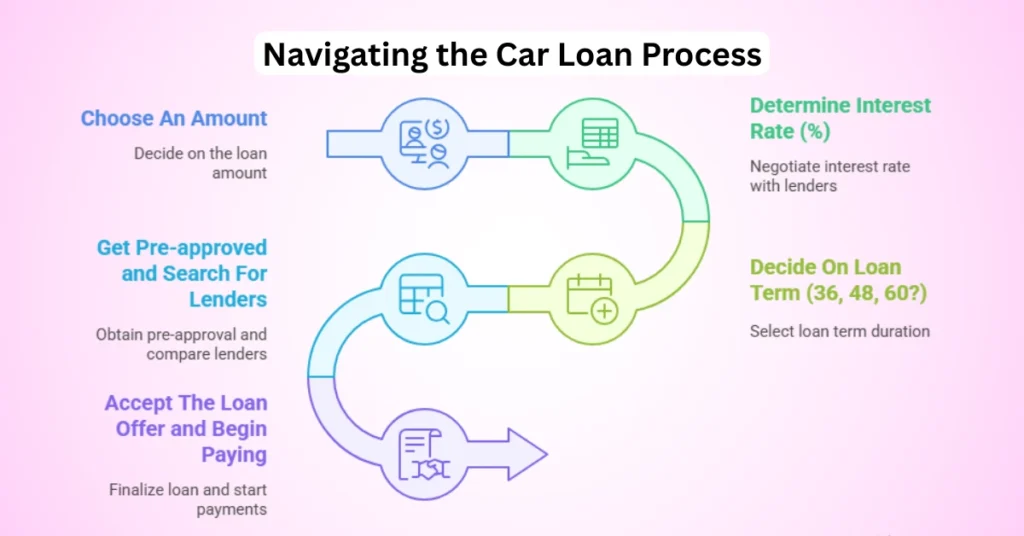

2. How Do Car Loans Work? (Step-by-Step Guide) 📖

Knowing how an auto loan works will enable you to make informed decisions that will save you money.

Step 1: Choose An Amount 💰

This amount will vary according to the price of the car, minus any down payment you initially make.

- Example: A $20,000 car with a $5,000 deposit would require a $15,000 loan.

- Higher initial payments reduce the loan amount, leading to a lower interest rate.

Step 2: Determine Interest Rate (%) 📉

Interest rate is the amount of money paid over and above the principal amount per unit of time, which the lender charges for the loan received. Depending factors include:

- Your Credit Score (Higher equals lower rate)

- Term of the loan (Shorter equals lower interest rate)

- Type of Institution (Difference in rates from banks, credit unions, and dealerships)

💡 What interest rates for auto car loans are standards?

- Good: (750+) 3-5% APR

- Fair: (650-749) 5-8% APR

- Poor: (sub 650) 10-20% APR

🚨 Note: A car loan calculator is a helpful way to understand your payments and do interest comparisons!

Step 3: Decide On Loan Term (36, 48, 60?) 📆

The time needed to pay off the loan in full is known as the loan term.

- Shorter Term (36 months): Higher Monthly Payments, Lower Total Payments.

- Longer Term (60+ months): Lower Monthly Payments, Higher Total Payments.

Example:

- With a loan of $20,000 at 5% for 36 months results in $599 monthly payments.

- The same loan for 60 months results in lower payments of $377, but the overall interest paid increases!

⚠️ Be careful with terms over 72 months. Monthly payments may appear cheap, but they will cost more over the long term.

Step 4: Get Pre-approved and Search For Lenders 🏦

- Request pre-approval from multiple banks, credit unions, and online lenders to find the best auto loans.

- Review all offers and select the one with the lowest rates.

- Steer clear of dealership financing unless they provide 0% APR offers.

Step 5: Accept The Loan Offer and Begin Paying 💳

Once accepted, you will sign a car loan agreement and start monthly payments.

💡 Note: Set up auto-pay so you never miss a due date!

3. How Do Car Loans Work? (Step-by-Step Guide) 📖

Obtaining an auto loan is no longer a simple case of choosing a car; you now must analyze loan terms, interest rates, and the monthly payment to ensure it is reasonable. Here is how it all works:

🟢 Step 1: Determine How Much You Will Borrow

Sometimes, you do not need to finance the entire vehicle value.

💡 Formula: Cost of the Car – Down Payment = Loan Amount

👉 Example: A car worth $25,000 with a $5,000 down payment requires a loan of $20,000. The greater the down payment, the lower the loan, which leads to lower interest rates. You win!

🟢 Step 2: Comprehend Auto Loan Interest Rates (%)

An interest rate is the additional cost you incur while trying to repay a loan from the lender.

🚨 Did you know? The annual percentage rate is another significant factor to consider when paying for a car. These rates can completely alter the inflation forecast by turning a cheap car investment into an expensive, life-altering debt.

Your rate will be affected by the following:

- Credit score (higher score lowers rate)

- Loan term (the shorter it is, the less interest paid)

- Lender type (bank vs credit union, dealership)

💡 What is a reasonable interest rate for a car loan?

- 750+ – Excellent credit → 3 – 5% APR

- Good credit (650 – 749) → 5 – 8% APR

- Bad credit score (650-20) → 10-20% APR (Ouch! 😬)

🟢 Step 3: Identify the Appropriate Loan Duration (36, 48, or 60 Months?)

A loan term, the time required to repay your loan, influences your monthly payment and interest rate.

- Short-term loans (36 months) → Increased monthly obligations, but your overall expenses decrease.

- Long-term loans (60-72+ months) → Reduced monthly obligations, however, increased interest payments.

💡 Example:

A $20,000 loan at 5% APR will look like this:

- 36 months → $599/month (least expensive option overall)

- 60 months → $377/month (more expensive option over the long term)

🚨 Common misconception: Loans exceeding 72 months seem reasonable because they have lower payments. However, they will ultimately cost more interest!

🟢 Step 4: Compare Lenders And Get Pre-approved

Make sure that before you go to the dealership, get auto loan pre-approval from:

- 🏦 Banks and Credit Unions (better rates for people with excellent credit)

- 💻 Online Lenders (approves very quickly)

- 🚗 Dealerships (they might give you 0% APR, but they will charge you other fees afterward)

Make sure you compare many different loan offers before fully accepting one from a lender.

🟢 Step 5: Start Paying Monthly And Finalizing Loan

When signing a contract with the bank, you must make monthly payments. Automatic payments should be set to avoid forgetting about them!

4. Types of Auto Loans & Choosing the Right One

Let’s highlight the information step by step, as all car loans are not the same. With the right selection, you could save hundreds or thousands of dollars.

🛑 New Car Loan vs. Used Car Loan – Which One Should You Pick?

🚘 New Car Loan: Payments for new car loans tend to have:

- ✅ Lower interest rates

- ✅ Available with a longer loan term

- On the flip side, there tend to be:

- ❌ A Higher total amount of loan

🚗 Used Car Loan: On the contrary, the used car loan tends to have:

- ✅ A still lower overall amount

- ✅ Leads to lesser depreciation

- However, the used car loans can have:

- ❌ Higher interest rate since lenders are more cautious about loaning used cars.

💡 Tip: Instead of new brand cars, a slightly used car (1-3 years old) would suit your budget better.

🏦 Bank vs. Dealership Auto Loans – What’s Better?

- 🏦 Bank or Credit Union Auto Loans

- ✅ Very effective when it comes to good credit. Bank and credit unions tend to have:

- Lower interest rates

- More openness with their fees, hiding less of them.

- ❌ You need to have pre-approval before the shopping around for cars commences.

🚗 Dealer Financing: It tends to:

- ✅ This gives you an advantage since you can apply directly at the dealership.

- ✅ Some may even provide 0 APR financing; however, this is limited to people with top credit scores.

- ❌ But from our experience, they tend to include extra charges that are not revealed, and higher rates are very common.

💡 Tip: Get a bank pre-approval before visiting the dealerships, as you can use pre-approval as negotiation power!

💰 No Credit Check Auto Loans – Are They Worth It?

If you have bad credit or no credit history, some lenders may offer you a no-credit-check auto loan. But caution is advised!

🚨 Risky because:

- ❌ extremely high Interest rates (20-30% AP!)

- ❌ Some lenders are scammers who will ensnare you in terrible deals

- ❌ The chances of you paying double the car’s value are possible

💡 Better alternative: Try credit unions or bring on a co-signer with better credit willing to qualify for a normal loan!

🔄 Auto Loan Refinancing – When and Why?

Do you currently have a car loan but resent your interest rates? You can now refinance!

✅ When should you refinance?

- If your credit score has improved since you took the loan.

- If you have been paying a high interest rate.

- If you need lower monthly payments,

💡 Example: If a customer initially has 12 percent interest on a loan but then qualifies for 5 percent interest, the customer payments would be greatly reduced if they refinanced.

5. Auto Loan Requirements & How to Qualify ✅

Every lender needs to assess whether you can repay the money before granting you auto financing.

🟢 1. Credit Score – The Game Changer 📊

Your credit score matters the most, not only when it comes to getting approved but also when it comes to determining the interest charged.

- Excellent credit (750+) → Easy approval & lowest interest rate

- Good credit (650-749) → Get approval while paying reasonable interest

- Fair credit (600-649) → Approval with higher interest rates

- Bad credit (below 600) → Extremely low chances of approval, high rates

💡 Note: Don’t apply without checking your score. If you need to improve it, it is best to do so before applying for a loan!

🟢 2. Proof of Income – Can You Afford the Loan? 💵

Having a stable income is a prerequisite for financing because lenders want to ensure that you have the resources to make the monthly payments.

- Paystub (for employed)

- Tax returns (self-employed borrowers)

- Bank statements (if the income is irregular)

💡 Note: For most lenders, a minimum monthly income of $1,500 to $2,000 is necessary to qualify for financing.

🟢 3. Debt-to-Income Ratio (DTI) – Maybe you can take on more debt? 📉

This is your DTI – the portion of your income that goes to servicing your existing debt.

👉 Formula: ( Monthly Debt ÷ Monthly Income ) × 100 = DTI%

✅ Below 36% → BEst chance of approval

⚠️ Above 50% → Risky teritory – may get denied

💡 Tip: Pay off some debts before time so that your DTI goes lower to increase the chances of approval.

🟢 4. The Need for Of a Down Payment 💰

Some lenders do issue zero down payment loans, but paying down something will help lower the interest and monthly payments.

✅ Downpayment: 10-20% of the price of the car

✅ Larger downpayment leads to a lower loan and less interest of the loan.

💡 Tip: If a large downpayment is not possible, at least try and pay the taxes and fees to reduce the loan amount.

🟢 5. A Valid ID and Proof of Residency 🏠

Lenders need to identify you and know what address you reside in.

✅ Driver’s license or passport

✅ A utility bill or lease agreement in you name for the address.

6. Smart Tips to Get the Best Auto Loan Deal 🚀

Let’s figure out how to secure the best deal for your vehicle and get the most bang for your buck.

🟢 1. Get A Pre-Approval Before Shopping For Cars 🏦

Prior approval for an auto loan can be obtained from an online lender, bank, or credit unit, and this should be done before visiting the dealership.

- Helps you know your budget

- Gives you negotiation power

- Protects you from high dealership loan rates

💡 Tip: Always compare at least three lenders to find the lowest interest rates!

🟢 2. Work On Increasing Your Credit Score Before Applying 📈

If the score is relatively low, it is prudent to wait a few months to apply while focusing on improving it.

- Pay off small debts

- Avoid late payments

- Don’t apply for multiple loans at once (lowers score)

💡 Tip: Avoiding credit debt will result in a score higher than 700, which can save thousands in interest.

🟢 3. Aim For The Shortest Loan Term That Is Reasonably Affordable ⏳

Longer loan terms will ultimately lead to a greater amount of interest having to be paid.

🚘 For example, For a loan of twenty thousand dollars for 5 percent, interest per annum would look like this:

🔹 36 months → Payments are high, but the total interest is lower.

🔹 60 months → Payments are low, but the total interest increases.

💡 Tip: For 36 to 48 months, aim for this to prevent the chance of overspending.

🟢 4. Paying Expenses and Fees that Arise Unexpectedly ❌

Certain dealerships plop in additional costs, such as:

- Additional extended warranty

- Unnecessary GAP insurance

- Warranty and service contract

💡 Read: Double-check your loan agreement and always ensure you get an itemized list of fees to be paid before signing the documents.

🟢 5. Refinancing is an option to consider if you are considering losing money in a deal. 🔄

- Is your auto loan set at a steep interest rate? Lowering one’s interest rate is possible through refinancing.

- If your credit score gets better, the changes tend to automate.

- Reduces monthly payment obligations

- Results in young people saving a lot more on interest

💡 Read: It’s advisable to look at options for refinancing 6-12 months after taking the loan!

7. How to Repay an Auto Loan the Smart Way 💡

A loan payment is more than just a monthly billing cycle; it includes saving for the future, safeguarding your credit, and managing your existing debt.

🟢 1. Always Pay on Time and Setup Auto-Pay ⏳

Payments and credit scores alike appreciate consistency!

Paying on time:

- Helps avoid late fines

- Enhances payment score

- Alleviates stress (no chance of forgetting)

💡 Tip: Otto-pay may allow rate discounts (0.25%-0.5%) if offered by providers.

🟢 2. Strive to Pay above the Minimum Payment Level. Dry Save funds 💰

Actually, extra payments can save you an immense amount of money, finally reducing your loan period by years.

Example: A loan of $20,000 with an interest of 5%, payable in 60 months.

A minimum payment of about $377 requires an accumulation of $2,645 for interest.

If I add an extra $100, I will save $611 in interest payments while opting to pay it off one year earlier.

💡 Tip: A longer loan payment period can be achieved by adding $25-$50 each month.

🟢 3. Use bi-weekly payment plans instead of monthly ones. 💳

Adjusting your payment approach can make clearing a loan easier and quicker!

Instead of settling 12 payments monthly, pay half every two weeks. That is an additional annual payment, meaning you are now clearly paying 13 full payments.

💡 Tip: Your lender should allow for early payments without additional charges.

🟢 4. Net Extra Savings by Rounding Up Payments 🤵🏽

For instance, if your monthly payment is $377, instead of paying the exact amount, you could pay $400.

- You will not notice a significant dent in your revenue

- You Generally Lose Debt Quickly

- You’ll incur less interest over the long run

💡 Tip: You can also help by rounding up payments by $20-$30 per month if you are able to.

🟢 5. Change It If A Better Rate Comes Up 🔄

If your credit score has increased or applicable interest rates have dropped, refinancing can shift the amortization schedule to lower monthly payments and total interest costs.

- Changes in payment obligation during the remaining loan term will benefit people with high-rate loans

- Changes in credit score benefit a person; loan repayment will improve the credit score over time.

- Saves hundreds to thousands during the loan period.

💡 Tip: Keep checking the new lender for any refinancing offer!

8. Common Mistakes to Avoid When Repaying an Auto Loan 🚨

Countless car buyers suffer from loss of money or deterioration of credit scores because of common, basic errors. Here is a summary of the mistakes not to make:

🛑 1. Missing Payments: Even skipping one can hurt you.

Missing even a single payment could result in:

- Reduction in your credit score.

- Incurring additional late fees.

- Possible car repossession if payments continue to be missed.

💡 Fix: If you need assistance, contact your lender immediately. They may provide deferment options or suggest modified payments.

🛑 2. Avoid Taking a Long Loan Term for the Sake of Lower Monthly Payments.

While a 7-year loan may look appealing, a longer repayment period results in an increased interest burden, and payments will be higher over the long term.

🚘 Example: In the case of a 25,000 dollar loan at 6% APR.

🔹 4 years = $3,200 interest

🔹 7 years = $5,600 interest

💡 Fix: Where possible, try to restrict your loan duration to 36 to 48 months, as this would decrease the overall amount spent.

🛑 3. Refusal to Acknowledge Additional Fees and Prepayment Penalties.

Certain loans impose penalties when you attempt to pay the loan beforehand.

💡 Fix: Before signing any loan documents, ask about penalties for early repayment.

🛑 4. Avoid or relieve the habit of not monitoring your loan balance periodically.

Some lenders incorporate extra payments towards upcoming bills instead of lowering the principal balance.

💡 Fix: Check how your payments have been applied. Make sure that any extra payments you have made are applied to your principal balance.

🛑 5. Car Deal In Too Soon

Putting previous loan balances into a new car loan results in negative equity, where the debt exceeds the vehicle’s value.

💡 Fix: Hold off on trading until your loan balance exceeds the car value.

9. How an Auto Loan Affects Your Credit Score 📈📉

Your credit score equals your auto loan payment, reflecting your financial reputation. Depending on your history with managing finances, lenders, landlords, and certain employers may check your score.

An auto loan can have a favorable or unfavorable impact on your credit, depending on how you manage it.

🟢 Positive Effects of an Auto Loan on Your Credit Score

1️⃣ Builds Payment History 🏦

- Payment history accounts for 35% of your credit score.

- Paying your bills slowly and on time every month will certainly raise your score.

- Auto loans also come with negative consequences. A single late payment can decrease your score by 50-100 points!

💡Helpful hint: Consider setting up auto-pay to ensure you don’t miss payments!

2️⃣ Increases Credit Mix 🔄

- In this case, the financial institution would prefer to see a combination of different types of credit (credit cards, loans, mortgages).

- With an auto loan, you now have installment credit, enhancing your credit profile.

- Having a mix of different types of credit may help your score.

3️⃣ Proves Your Capability of Handling Debts 💡

- Being able to pay off your car loan promptly demonstrates that you are a borrower of good standing.

- Future lenders will perceive you as a low-risk borrower (mortgages, personal loans).

🛑 Consequences of an Auto Loan: Credit Score 🥀❌

1️⃣ Score Loss Due to Hard Inquiry (Temporarily) ⏳

As part of the application process, the lender will request your credit report, which can lower your score by 5 to 10 points for a couple of months. This is known as a hard Para. Numerous loan applications over a short period will cause your score to decrease even more.

💡Tip: Look for auto loans within two weeks so that the credit bureaus consider your inquiry.

2️⃣ Payments Not Made Can Decrease Your Score 📉

Missed or late payments affect your credit. Anytime a payment is 30 days overdue, it is reported to credit bureaus. A missed payment, which is only one payment within the span of 7 years, sticks to your account.

💡TIP: If you struggle to make payments, contact your lender immediately. There might be payment alternative options.

3️⃣ Poor Management of Money Would Impact Credit Utilization Ratio 📊

Too much debt can lead to an increased debt-to-income ratio, negatively impacting your score. If the car loan payment is too high, it would affect your debt-to-income ratio.

💡Tip: Opt for an auto loan that is reasonable for you. Do not exceed the limit of borrowing 15% of your monthly income.

10. Tips for Smart Borrowing & Managing an Auto Loan Like a Pro 🏆

Anyone can easily obtain an auto loan, but how it’s managed is entirely different. Here are a few habits one can adopt to become a smart borrower.

🟢 1. Understanding the Credit Score Before Applying 📊

The value of credit determines the rate of interest. The lower the interest, the less you will pay in the long term. This makes having good credit (above 600) extremely essential.

💡 Tip: AnnualCreditReport.com allows checking your credit report for free before applying.

🟢 2. Research Assumed Loan Rates 🚘

Dealerships are not the only institutions offering auto loans. Banks, credit unions, and online lenders often also have promo sales. Even a small 1-2% discount can make a drastic difference and save you money throughout the loan.

💡 Tip: Getting pre-approved can be useful because it gives you more negotiation power at the dealership.

🟢 3. Opt for a Shorter Loan Length ⏳

Most people make the mistake of choosing longer loans as they pay off money, but this only leads to more negative revenue in the long run.

💡 Example A: If a $25,000 car loan was taken with 6% APR

🔹 3-year loan = $2,400 interest

🔹 6-year loan = $4,800 interest (DOUBLE!)

🟢 4. Bigger Initial Deposit 💰

Having more money first makes the paying-off part easy.

A 20% down payment ensures you will never owe more than your car is worth.

💡 Tip: Avoid $0 down payment offers since they usually include more expensive interest rates.

🟢 5. Beware of Early Payoff Fees 🚨

Some banks impose a fine for repaying the loan balance prematurely, which makes meeting your savings goal harder due to lost interest.

💡 Tip: Ask about prepayment fees and penalties before closing the loan agreement.

🟢 6. Make Additional Payments When Available 💵

Paying more than the required minimum payment helps to pay off the debt more quickly. A mere $50 more each month could reduce that loan by several months.

💡 Tip: Ensure any extra payments are directed to the principal, not future accrued interest.

🟢 7. Decline Dealer-Added Features Financing 🚗

Dealers often aggressively market add-on features such as protective coverages, gap cover, extended warranties, and protection plans, which get integrated into the loan, thus raising both the monthly payment and accumulated interest paid on the borrowed money.

💡 Tip: Purchase additions later to prevent being overcharged because of interest payments.